Solana ETF Rumors Dashed as BlackRock CIO Emphasizes Bitcoin and Ethereum Focus

In the last two weeks, Solana has jumped 30%, outpacing both Bitcoin and ETH. Therefore, many are anticipating that this surge is coming

Solana has outperformed both Bitcoin and ETH in the last two weeks with a 30% surge. As a result, many are speculating that this surge is being caused by rumors of a Solana ETF. However, Blackrock may have just put a damper on the dreams of many Solana investors.

In a recent interview with Bloomberg, BlackRock’s CIO for ETF and Index Investments, Samara Cohen, stated that Bitcoin and Ethereum will continue to be the primary cryptocurrencies available for trading via ETFs in the upcoming months.

According to Cohen, there is not enough demand for other altcoins, including Solana, to be included in crypto ETFs.

The Appetitie for Solana ETF

Cohen went on to explain that while Bitcoin and Ethereum meet the criteria for volatility and client interest, other cryptocurrencies have not reached the same level. She highlighted technical challenges and concerns about liquidity and market manipulation as key obstacles to introducing ETFs for altcoins such as Solana. This view is also shared by BlackRock’s head of digital assets, Robert Mitchnick, who does not foresee any other crypto ETFs in the immediate future.

Technical Hurdles

Bitcoin and Ethereum hold the lion’s share of the crypto market, with BTC and ETH contributing 55% and 17% to the total market capitalization, respectively. The remaining altcoins each contribute less than 10%, making the case for their inclusion in ETFs weaker. Despite Solana’s recent strong performance and market cap of $82 million, which even saw it surpass Binance’s BNB token in market capitalization, BlackRock is still hesitant to expand its ETF offerings beyond Bitcoin and Ethereum.

Crypto ETFs in Model Portfolios

In other news, Cohen also revealed that crypto ETFs could be included in “Model portfolios” by the end of 2024. Several major fund houses, including Wells Fargo, Morgan Stanley, and UBS, are conducting due diligence and risk analysis to determine the role of Bitcoin and Ethereum in their portfolios. Notably, BlackRock’s Ethereum ETF, ETHA, has seen substantial inflows since its launch, indicating strong investor interest in the asset.

Future Prospects for Other Altcoins

While other asset managers, such as VanEck and 21shares, are advocating for Solana ETFs, citing high demand from the crypto community, the approval for such ETFs remains uncertain. Despite Solana’s bullish price outlook and analyst Ali Martinez’s bold prediction of a 900% price surge, many experts are skeptical of any new crypto ETFs being approved in 2024.

Earlier, Ripple CEO Brad Garlinghouse had predicted the launch of multiple altcoin ETFs this year. However, Bloomberg analyst Eric Balchunas pointed out that the final deadline for Solana ETFs is mid-March 2025, with a critical date in November.

What are your thoughts on the possibility of Solana ETF failing to hit the market this year? Share your views in the comments below.

The above is the detailed content of Solana ETF Rumors Dashed as BlackRock CIO Emphasizes Bitcoin and Ethereum Focus. For more information, please follow other related articles on the PHP Chinese website!

Is Wall Street Quietly Backing Solana? $42 Million Bet Says YesApr 10, 2025 pm 12:43 PM

Is Wall Street Quietly Backing Solana? $42 Million Bet Says YesApr 10, 2025 pm 12:43 PMA group of former Kraken executives acquired U.S.-listed company Janover, which secured $42 million in venture capital funding to begin building a Solana (SOL) treasury.

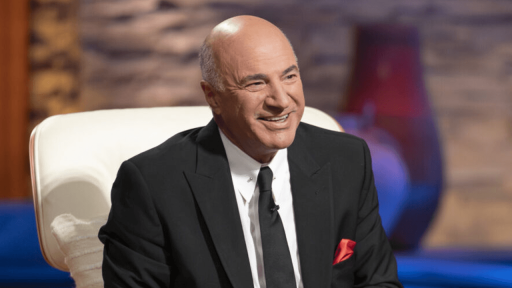

Kevin O'Leary Urges Trump to Impose 400% Tariff on Chinese GoodsApr 10, 2025 pm 12:35 PM

Kevin O'Leary Urges Trump to Impose 400% Tariff on Chinese GoodsApr 10, 2025 pm 12:35 PMCanadian businessman and investor Kevin O’Leary urged the Trump administration to impose a 400% tariff on Chinese goods, arguing that the current 104% tariff is insufficient to compel China to follow trade rules. O’Leary said these statements prior t

Regulatory roadblocks are crumbling as the U.S. Treasury signals a sweeping pivot toward blockchain, stablecoins, and digital assetsApr 10, 2025 pm 12:27 PM

Regulatory roadblocks are crumbling as the U.S. Treasury signals a sweeping pivot toward blockchain, stablecoins, and digital assetsApr 10, 2025 pm 12:27 PMU.S. Treasury Secretary Scott Bessent laid out a broad financial reform agenda at the Bankers Association Summit on April 9, pledging to remove regulatory barriers

China and Russia Have Started to Settle Some Trade Deals Using BitcoinApr 10, 2025 pm 12:19 PM

China and Russia Have Started to Settle Some Trade Deals Using BitcoinApr 10, 2025 pm 12:19 PMAccording to a report by VanEck, China and Russia have started to settle some trade deals using Bitcoin.

Skybridge Capital's founder warns China is preparing fierce economic retaliation as the U.S. slaps 125% tariffs on Chinese goods, signaling currency shocks, massive stimulus, and financial warfare.Apr 10, 2025 pm 12:03 PM

Skybridge Capital's founder warns China is preparing fierce economic retaliation as the U.S. slaps 125% tariffs on Chinese goods, signaling currency shocks, massive stimulus, and financial warfare.Apr 10, 2025 pm 12:03 PMucci Outlines 5-Point Forecast on China's Next Moves Amid Rising Trade Tensions

Ethereum (ETH) Underperforms Bitcoin (BTC)Apr 10, 2025 pm 12:01 PM

Ethereum (ETH) Underperforms Bitcoin (BTC)Apr 10, 2025 pm 12:01 PMunderperformed Bitcoin on 85% of all trading days since it launched in 2015. The ETH/BTC ratio, which tracks the value of Ether relative to Bitcoin, dropped to a five-year low of 0.018

President Trump's Tariff Announcement Sent Bitcoin Dropping 5.4%Apr 10, 2025 am 11:53 AM

President Trump's Tariff Announcement Sent Bitcoin Dropping 5.4%Apr 10, 2025 am 11:53 AMIn the world of cryptocurrencies, few events can shake things up like big government decisions. President Trump's recent tariff announcement did exactly that

Bitcoin Surges Above $82,000 on Tariff Pause, XRP Rallies on ETF LaunchApr 10, 2025 am 11:51 AM

Bitcoin Surges Above $82,000 on Tariff Pause, XRP Rallies on ETF LaunchApr 10, 2025 am 11:51 AMThe cryptocurrency market rebounded sharply after President Trump announced a 90-day tariff pause for non-retaliating countries, with Bitcoin surpassing $83,000 and XRP gaining 13% to reclaim the $2 level

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

Notepad++7.3.1

Easy-to-use and free code editor

Dreamweaver CS6

Visual web development tools

Atom editor mac version download

The most popular open source editor

SublimeText3 Chinese version

Chinese version, very easy to use