Technology peripherals

Technology peripherals It Industry

It Industry The billion-dollar giant failed to survive the price war - China Grand Automobile

The billion-dollar giant failed to survive the price war - China Grand Automobile

On July 16, China Grand Automobile’s closing price has been below 1 yuan for 19 consecutive days, and the closing price on that day was 0.87 yuan. Even if the price limit was raised the next day, the stock price would be difficult to return to 1 yuan. At this point, China Grand Automobile triggered the delisting requirement of "the stock price is less than 1 yuan for 20 consecutive trading days". Therefore, delisting was locked in advance and became the stock with the largest market value at the time of delisting in the history of A-shares, with 72 A huge amount of billions.

However, according to the financial report, China Grand Automobile's revenue in 2023 will still reach 137.998 billion yuan, with total vehicle sales of 713,000 vehicles. It is still China's largest automobile dealership group in terms of total passenger vehicle sales and second in revenue scale. In the capital market, after backdooring Metro Pharmaceuticals to go public in 2015, China Grand Automobile's stock price soared to a maximum of 32.12 yuan per share, and its market value once reached the 100 billion mark, making it an unparalleled success.

How did this former billionaire giant fall to this level?

1. Behind the ups and downs of Guanghui Automobile is Sun Guangxin, the richest man in Xinjiang.

On March 26, 1999, Guangqi Honda opened a 4S store in Baiyun District, Guangzhou. This is the first 4S store in China’s automotive history, pioneering the “four-in-one” sales and service model. A few months later, Sun Guangxin established China Grand Automobile in Urumqi.

In the following ten years, China Grand Automobile emerged with the continued prosperity of China's automobile industry - accelerating its expansion in China's first- and second-tier cities through new construction, mergers and acquisitions, joint ventures, etc., forming a nationwide 4S distribution network.

On June 24, 2015, China Grand Automobile successfully went public through a backdoor merger with Luomei Pharmaceutical. It was at its peak when it debuted, with a closing market value of 84.6 billion yuan that day. In the following years (2015-2017), China Grand Automobile performed well - revenue increased from 93.7 billion to 160.7 billion, and net profit attributable to the parent increased from 2 billion to 3.9 billion.

The hot automobile market and brilliant performance make Sun Guangxin confident in the company's future prospects and increase leverage to deploy luxury brand distribution business. In 2016, Guanghui spent tens of billions to acquire Baoxin Automobile, the world's largest BMW dealer.

After the merger and acquisition was completed, it did not take long to surpass the American AutoNation company and become the world's largest car dealer. But what Sun Guangxin didn't expect was that Guanghui began to turn from prosperity to decline in 2018, with revenue growth basically stagnating and profits attributable to the parent company continuing to decline. By 2021, it would only be 1.6 billion yuan.

During this period, Guanghui Group had interactions with Evergrande Group. The latter planned to make a strategic investment of 14.5 billion yuan and became the former’s “second largest shareholder”, which once caused a sensation in the capital market. For Sun Guangxin, 2022 may be the most difficult year. China Grand Automobile's revenue plummeted by 25 billion to 133.5 billion, with a huge profit loss of 2.7 billion. This was the company's first loss since its listing, and its 11-year streak of being No. 1 in the industry came to an abrupt end. Zhongsheng Group overtook it and ranked second.

In 2023, the epidemic has been fully relaxed, and China Grand Automobile has turned losses into profits, but its profits are as thin as paper - the gross profit margin is only just over 6%, and the net profit margin is less than 0.5%. In the first quarter of this year, performance continued to deteriorate, with revenue falling 12% and profits plummeting nearly 90%. As operations shrink and profitability deteriorates, the capital market naturally votes with its feet.

In the first half of this year, Guanghui’s stock price fell by 60%, and it was on the verge of delisting. It has been struggling to this day.

Perhaps it can be said that the start, growth, rise and decline of China Grand Automobile are a microcosm of China's automobile dealership industry.

2. Why is this? "All these problems have always been there, everywhere, but they will be covered up when the market is good. Now the dealers are not making money. Price wars are fought every day in the automobile market, and Guanghui is being dragged to death." An industry insider commented. .

Does this statement make sense?

A fact that cannot be ignored is that China Grand Automobile’s operating performance in recent years has been very pessimistic.

Once upon a time, China Grand Automobile, which started out by selling joint venture brands of fuel vehicles such as Toyota, Honda, General Motors, and Volkswagen, also had its moments of glory. In an era when foreign brands are making money on their own, China Grand Automobile Co., Ltd. is also making a lot of money. However, with the rise of new energy vehicles and domestic independent brands, China Grand Automobile, which did not turn around in time, began to go downhill.

According to the financial report, China Grand Automobile suffered its first loss since its listing in 2022, reaching nearly 3 billion yuan. Even if it turns a profit in 2023, compared with the revenue of 138 billion yuan, the net profit of 392 million yuan still seems a bit thin.

Among the car brands sold by China Grand Automobile in the past, 30% were luxury car brands and 70% were mass-market brands. This makes it possible that even in the peak year of 2018, China Grand Automobile's bicycle revenue ranked last among the top ten car dealers in China, at about 140,000 yuan, which was nearly 10 years behind Zhongsheng Group, which ranked second. 10,000 yuan, which is nearly 200,000 yuan lower than the third-placed Lei Shing Hong.

The lower unit price means that the company’s ability to resist risks is also much worse. As the price war between car companies began, China Grand Automobile's profits suffered a heavy setback.

After nearly two years of adjustments, as of December 31, 2023, China Grand Automobile operates a total of 735 business outlets, of which luxury car stores have increased to 1/3 of the total stores. However, what makes Sun Guangxin depressed is that as the price war between car companies intensifies, not only Volkswagen brand cars are reducing prices, but even luxury car brands such as Mercedes-Benz, BMW, Audi, Land Rover, Cadillac, and Porsche have also joined promotions in recent months. The war has doubled the pressure on the dealers.

中国グランド汽車も競争激化を受けて発表 2024年上半期の上場企業の株主に帰属する純利益損失は5億8,300万~6億9,900万元に達すると予想される。

さらに、値下げより恐ろしいのは、値下げしても誰も買わないことです。新エネルギー車の台頭により、現在の新エネルギー乗用車の国内普及率は48.4%に達し、中国自動車における国内独立ブランドの市場シェアは50%を超えた。中国グランド汽車は現在、燃料車の合弁ブランドを主に展開しており、新エネルギーと自社ブランドの店舗は全体の10分の1にも満たない。

中国グランドオートモービルも新エネルギー車への変革への取り組みを強化しています。今年6月末の時点で、光匯は70の新エネルギー貯蔵施設の認可を申請している。しかし、現在の市場環境は楽観的ではなく、新エネルギー車の価格も上昇しており、従来の自動車ディーラーの変革のジレンマは依然として解決が困難です。

ディーラーグループにとって、規模が大きくなるほどキャッシュフローの重要性は高まり、中国グランドオートモービルの経営困難はグループの資本チェーンに影響を与えている。

Phoenix.comの「Eye of the Storm」レポートによると、チャイナ・グランド・オートモービルは現在、全国の多くの都市の店舗で賃金の滞納があり、たとえ賃金が支払われていたとしても、基本的には50%割引となっている。

中国グランド汽車は給与削減に加えて、実際に過去1年間に人員削減や店舗閉鎖などのコスト削減と効率向上のための措置を実施してきた。財務報告書によると、2023年の中国グランド汽車の従業員数は3万5750人となり、2022年の4万2741人から6991人減少する。さらに、中国グランドオートモービルは2023年に、開発計画と運営戦略の調整により収益性の低い50店舗を削減し、17店舗のブランド転換を完了する予定である。

巣が覆われているとき、どうして卵が残らないのでしょうか?中国グランド汽車だけでなく、中国のほとんどの自動車ディーラーも苦境に立たされている。

中国自動車ディーラー協会のデータによると、2023年のディーラー損失の割合は、かつては「4Sストアの王」であった全国の約1,500~2,000社がネットワークから撤退するとのこと。ヒュージ・グループは上場廃止と上場廃止の窮地に陥っている。

The above is the detailed content of The billion-dollar giant failed to survive the price war - China Grand Automobile. For more information, please follow other related articles on the PHP Chinese website!

如何让自动驾驶汽车“认得路”Apr 09, 2023 pm 01:41 PM

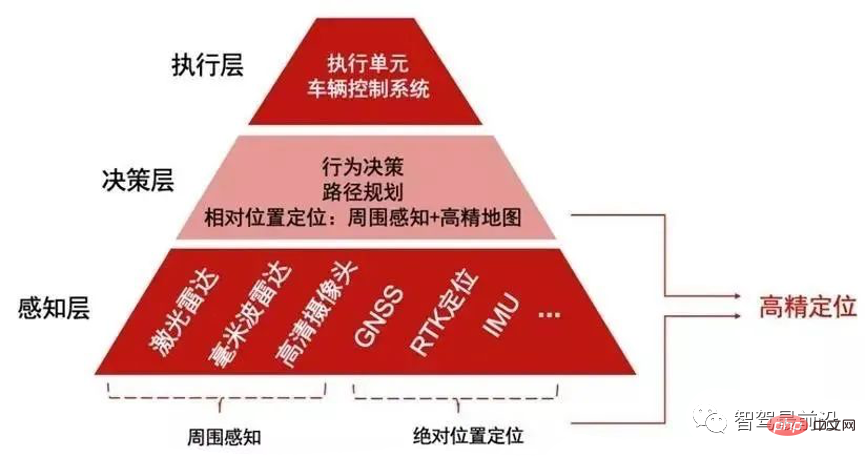

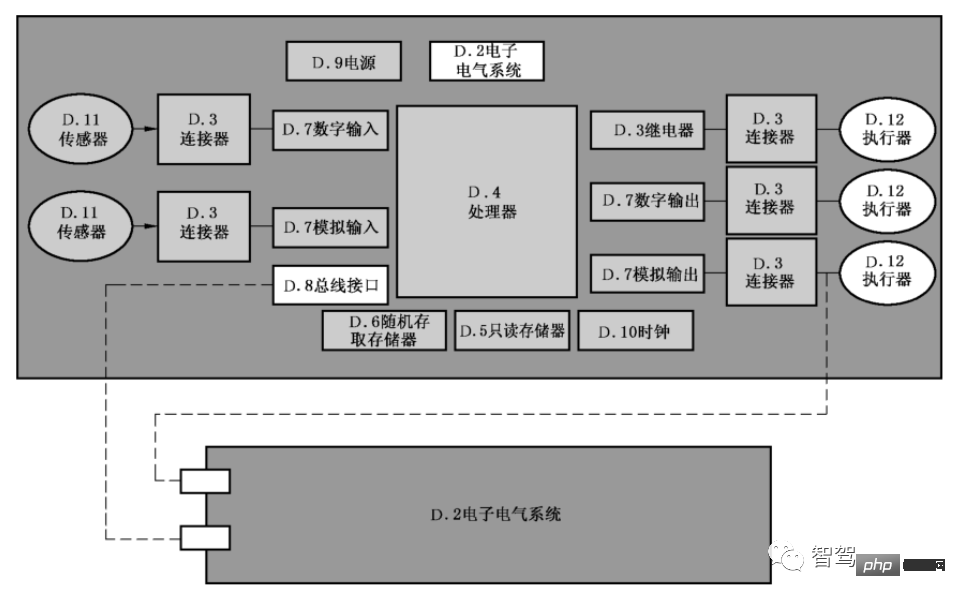

如何让自动驾驶汽车“认得路”Apr 09, 2023 pm 01:41 PM与人类行走一样,自动驾驶汽车想要完成出行过程也需要有独立思考,可以对交通环境进行判断、决策的能力。随着高级辅助驾驶系统技术的提升,驾驶员驾驶汽车的安全性不断提高,驾驶员参与驾驶决策的程度也逐渐降低,自动驾驶离我们越来越近。自动驾驶汽车又称为无人驾驶车,其本质就是高智能机器人,可以仅需要驾驶员辅助或完全不需要驾驶员操作即可完成出行行为的高智能机器人。自动驾驶主要通过感知层、决策层及执行层来实现,作为自动化载具,自动驾驶汽车可以通过加装的雷达(毫米波雷达、激光雷达)、车载摄像头、全球导航卫星系统(G

一文读懂智能汽车滑板底盘May 24, 2023 pm 12:01 PM

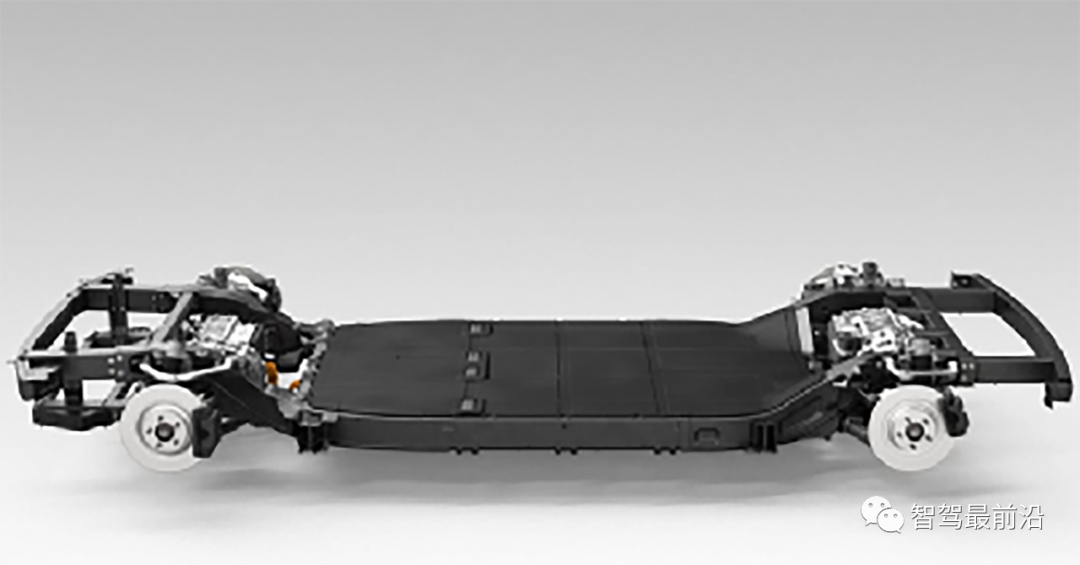

一文读懂智能汽车滑板底盘May 24, 2023 pm 12:01 PM01什么是滑板底盘所谓滑板式底盘,即将电池、电动传动系统、悬架、刹车等部件提前整合在底盘上,实现车身和底盘的分离,设计解耦。基于这类平台,车企可以大幅降低前期研发和测试成本,同时快速响应市场需求打造不同的车型。尤其是无人驾驶时代,车内的布局不再是以驾驶为中心,而是会注重空间属性,有了滑板式底盘,可以为上部车舱的开发提供更多的可能。如上图,当然我们看滑板底盘,不要上来就被「噢,就是非承载车身啊」的第一印象框住。当年没有电动车,所以没有几百公斤的电池包,没有能取消转向柱的线传转向系统,没有线传制动系

智能网联汽车线控底盘技术深度解析May 02, 2023 am 11:28 AM

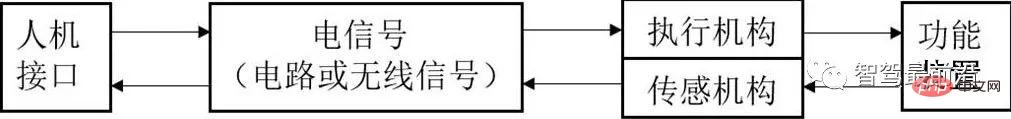

智能网联汽车线控底盘技术深度解析May 02, 2023 am 11:28 AM01线控技术认知线控技术(XbyWire),是将驾驶员的操作动作经过传感器转变成电信号来实现传递控制,替代传统机械系统或者液压系统,并由电信号直接控制执行机构以实现控制目的,基本原理如图1所示。该技术源于美国国家航空航天局(NationalAeronauticsandSpaceAdministration,NASA)1972年推出的线控飞行技术(FlybyWire)的飞机。其中,“X”就像数学方程中的未知数,代表汽车中传统上由机械或液压控制的各个部件及相关的操作。图1线控技术的基本原理

智能汽车规划控制常用控制方法详解Apr 11, 2023 pm 11:16 PM

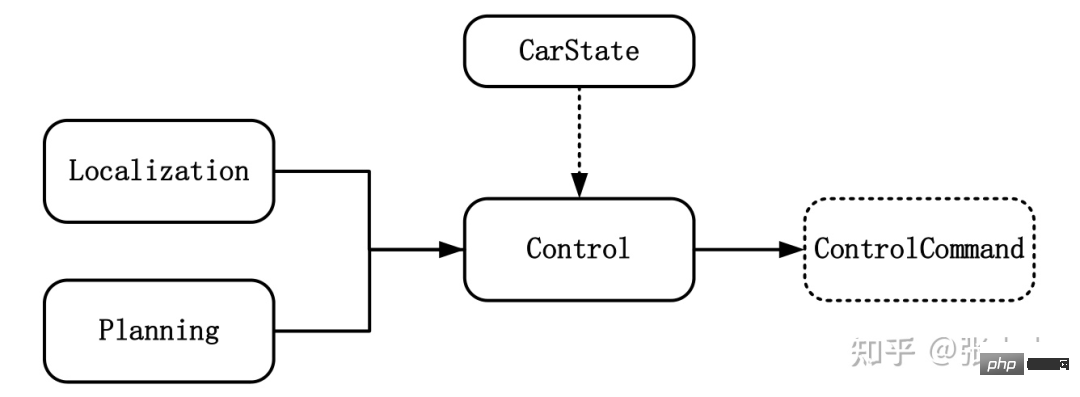

智能汽车规划控制常用控制方法详解Apr 11, 2023 pm 11:16 PM控制是驱使车辆前行的策略。控制的目标是使用可行的控制量,最大限度地降低与目标轨迹的偏差、最大限度地提供乘客的舒适度等。如上图所示,与控制模块输入相关联的模块有规划模块、定位模块和车辆信息等。其中定位模块提供车辆的位置信息,规划模块提供目标轨迹信息,车辆信息则包括档位、速度、加速度等。控制输出量则为转向、加速和制动量。控制模块主要分为横向控制和纵向控制,根据耦合形式的不同可以分为独立和一体化两种方法。1 控制方法1.1 解耦控制所谓解耦控制,就是将横向和纵向控制方法独立分开进行控制。1.2 耦合控

合创汽车发布新款MPV车型V09内饰设计,定于10月13日上市Sep 19, 2023 pm 01:17 PM

合创汽车发布新款MPV车型V09内饰设计,定于10月13日上市Sep 19, 2023 pm 01:17 PM9月9日消息,广汽旗下合创汽车日前发布了合创V09的内饰设计,并宣布该车将于9月10日开始接受预订订单,计划于10月13日正式上市。这款车型旨在进军新能源MPV市场,早在去年12月的广州车展上就已经首次亮相,被定位为中大型MPV,备受瞩目。根据官方发布的内饰预告,合创V09采用了2+2+3式的七座布局,提供黑橙、浅玉、曜黑三种内饰配色,兼具豪华感与运动感。其座舱设计以环抱式风格为主,中控台则采用了三块屏幕组合,其中中控屏悬浮式,液晶仪表和副驾屏幕则巧妙嵌入,整体呈现出简洁、平直的设计风格。细节方

福田汽车发布全新Logo,同时公布祥菱Q系列车型的售价信息Sep 12, 2023 pm 09:09 PM

福田汽车发布全新Logo,同时公布祥菱Q系列车型的售价信息Sep 12, 2023 pm 09:09 PM8月29日,福田汽车举办了一场华丽的品牌焕新发布会,给业界带来了一系列令人振奋的消息。新的标志、欧曼智蓝底部换电产品以及全新的祥菱Q汽车成为了发布会的关注焦点福田汽车的新标志展示了公司对未来的雄心壮志。福田汽车表示,这个全新的标志象征着品牌的更新和蓬勃发展,标志着公司进入了新的发展阶段在发布会上,福田汽车还推出了备受瞩目的欧曼智蓝底部换电产品,为用户带来了更便捷、高效的使用体验。同时,全新推出的祥菱Q汽车系列也吸引了众多目光,共有4款车型,售价从16.78万元到16.88万元不等,为消费者提供了

智能汽车功能安全软件架构Apr 27, 2023 pm 06:55 PM

智能汽车功能安全软件架构Apr 27, 2023 pm 06:55 PM01E-GAS安全架构思想汽车功能安全旨在把电子电气系统失效而导致的人身危害风险控制在合理范围内。下图是常见的电子电气系统硬件构成图,一个电子电气系统的构成要素,除了图中可见的硬件外,也包含图中不可见的软件。图1常用电子电气硬件系统电子电气系统的失效,既包含由于软硬件设计错误引起的系统性失效,也包含由随机硬件故障引起的失效。根据系统架构,需要设计各种安全机制去预防和探测功能故障,并能够在故障发生时,避免或者降低危害的发生。这就需要一个强壮的功能安全软件架构来管理和控制这些安全机制,降低功能安全整

理想汽车“家庭科技日”发布会预告:电能战略和全新电池技术引期待Jun 16, 2023 pm 05:54 PM

理想汽车“家庭科技日”发布会预告:电能战略和全新电池技术引期待Jun 16, 2023 pm 05:54 PM6月16日消息,理想汽车将于明天举行“家庭科技日”发布会,预告中透露了一些令人期待的看点。据悉,理想汽车在此次发布会上将推出一项名为“电能战略”的重大举措。此前,理想汽车已多次通过宣传海报和视频预热发布会,引起了广泛关注。据理想汽车官方海报显示,本次发布会将展示理想汽车新车型搭载的全新电池技术。预告中的海报进一步确认了之前的传闻,将“4C”换成了“5C”,暗示着理想汽车有望首发宁德时代的全新电池。据报道,这款新电池有望实现“10分钟快充500公里”的里程里程突破。这将为电动汽车充电时间和续航里程

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Atom editor mac version download

The most popular open source editor

Dreamweaver Mac version

Visual web development tools

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function