'German Address' Ends Sell-Off and Recovers, Will Trump's Assassination Bring Dramatic Changes to the Market?

- 王林Original

- 2024-07-19 12:30:401158browse

Author: 1912212.eth, Foresight News

Today, the price of Bitcoin rose steadily, once exceeding US$63,000, and ETH also exceeded US$3,300. Altcoins also followed the general market and rose. In the past 24 hours, short positions were liquidated to $90 million.

A major negative hanging over the market has finally been erased: On July 13, the balance of Bitcoin addresses seized by the German government showed that the sell-off may have ended. At this point, the large sell-off in mid-June has come to an end. You know, the selling pressure brought by these 50,000 BTC caused BTC to fall from a minimum of $65,000 to around $53,500. Panic spread in the market, setting a new annual low and crashing the altcoin market.

And Trump, who had just escaped from an assassination attempt, became popular all over the world for his photos of him cheering. After the incident, Trump’s election victory rate on the prediction market platform Polymarket has soared to 71%, setting a recent high and far exceeding current President Biden’s 18%. Based on his series of statements during this election cycle, if Trump ultimately wins the election, it will undoubtedly be a great benefit for the cryptocurrency market.

During a meeting with representatives of Bitcoin miners last month, Trump stated that he loves and understands cryptocurrency and will speak out for Bitcoin miners in the White House. He even posted on his social media company Truth Social that Bitcoin mining may be possible. It is our last line of defense against central bank digital currency (CBDC). We want all remaining Bitcoins to be MADE IN THE USA. Separately, Palantir Technologies consultant Jacob Helberg also told Reuters that Trump made it clear that Biden and Gensler's crusade against cryptocurrencies would cease within an hour of the second Trump administration taking office.

It is worth mentioning that Trump will also attend the Tennessee Bitcoin 2024 Conference and deliver a speech on July 27. If the probability of Trump winning the election continues to increase, the crypto market may usher in this event in advance. A potentially positive "price in" uptrend.

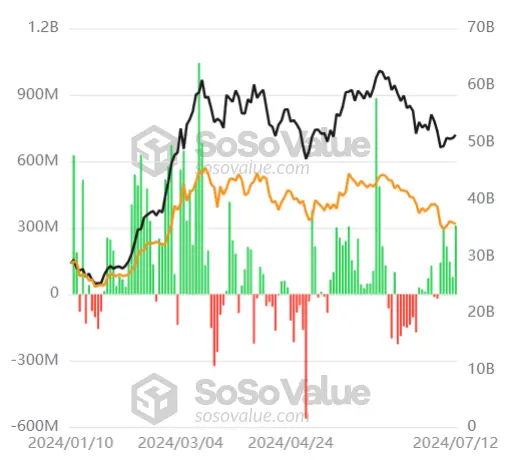

There is no movement in the distribution compensation of Mt.Gox for the time being. After months of markets languishing on relentless pessimism, the sell-off faded and the Bitcoin spot ETF posted bright numbers. ETF data began showing net inflows on July 5, and even on July 12, the total net inflows reached a staggering $310 million. According to IntoTheBlock data, Bitcoin whale addresses increased their holdings of 71,000 Bitcoins when the price retraced to $54,200 on July 5, worth approximately $4.3 billion.

Ethereum spot ETH approval is also very close. In terms of macroeconomics, the expectation of interest rate cuts has been changed from 1 to 2, and will be brought forward to September. With the support of a series of upcoming favorable conditions, let’s listen to the opinions of the experts on how the market will trend in the future.

Founder of Collective Shift: Bitcoin’s “partial bottom” has now been formed and is heading towards an upward trend

Ben Simpson, founder of the crypto education platform Collective Shift, said that Bitcoin’s local bottom has now been formed and is heading towards an upward trend. Bitcoin’s price has been hit by massive forced selling, much of it from the German government’s nearly $3 billion selloff, as well as negative sentiment over Mt. Gox’s creditors repaying about $8.5 billion. This week’s assassination of former President Trump has had a positive impact on his re-election chances, with the former president’s pro-crypto stance boosting positive sentiment for Bitcoin and crypto assets in the process.

Trader Eugene Ng Ah Sio: If Bitcoin’s weekly, daily and 4H K-line charts close above $60,000, a direct approach to $63,000 is very likely

Eugene Ng Ah Sio is Binance The top trader on the contract platform, whose cumulative contract income has exceeded US$28.65 million, said on his social platform that if Bitcoin’s weekly, daily and 4H K-line charts close above US$60,000, it will directly approach US$63,000. The possibility is very high. On the other hand, if it cannot hold and the upward momentum stagnates, then this may be the highest point for a long time. (Trying to regain the range and failing)

Trader T: Mentougou will be the next big seller, which may bring $4.62 billion in selling pressure before November

Trader T published a prediction on the X platform that after a week of German government’s After the strong sell-off, Mentougou Mt.Gox will be the next strong seller. Mt.Gox should repay a total of 14,100 Bitcoins. The repayment ratio should not be less than 80% before November this year, and the repayment discount rate is 89%. Mt.Gox sold at most 100,392 BTC before November. Given its dispersed ownership, the likelihood of a large-scale liquidation is low. According to the worst-case scenario that can be predicted, Mt. Gox sells 80% of the Bitcoins, which may bring liquidation pressure of US$4.62 billion.

10x Research: A bigger sell-off is likely in the coming weeks and months

Markus Thielen, founder of 10x Research, said in a report that continued concerns due to oversupply and a lack of solid market fundamentals pose potential risks to mid-term traders. Last week, Bitcoin appeared to have rebounded from oversold levels ahead of the release of the Consumer Price Index (CPI), which was expected to decline. However, since this expectation has become widely known and Bitcoin has risen, the price has been unable to sustain it. This trend of lower inflation is likely to continue into October, when year-over-year data will be more challenging.

Although Bitcoin prices experienced a nearly 20% correction at their lowest during the sale of $3 billion worth of Bitcoins in the US state of Saxony, it has withstood this test. However, a larger sell-off is expected in the coming weeks and months, which could further impact the market.

JPMorgan Chase: Cryptocurrency market expected to rebound in August

JPMorgan said in its latest research report that the crypto market is expected to start rebounding in August. Bitcoin reserves on major exchanges have declined over the past month due to creditor liquidations of Mt. Net flow estimates were revised down to $8 billion from $12 billion. The report states that liquidation activity should end this month and the market will resume from August.

Matrixport: Last week, Bitcoin ETF inflows hit a new high in a month, and buying gradually shifted from institutions to retail investors

Matrixport released the latest report saying that spot Bitcoin ETFs ended the week with an inflow of US$310 million last Friday. trading, hitting its highest level in more than a month. Previously, ETF flows have been closely correlated with inflation data, and last week's CPI data was weaker than expected, and ETF flows are likely to continue. Notably, institutional buying initially driven by high arbitrage opportunities has shifted to retail investors who are less sensitive to stop losses. This shift could see buying activity continue for longer, making it less reliant on macroeconomic data.

CryptoQuant founder: It is expected that the encryption market will be very flat in the next 2-3 months and remain bullish for the long term

CryptoQuant founder and CEO Ki Young Ju posted that the capitulation of Bitcoin miners is still going on In progress, historically this ratio ended when the average daily extraction value reached 40% of the annual average, but now the ratio figure is 72%. Cryptocurrency markets are expected to be flat over the next 2-3 months, remaining bullish for the long term but avoiding excessive risk.

The above is the detailed content of 'German Address' Ends Sell-Off and Recovers, Will Trump's Assassination Bring Dramatic Changes to the Market?. For more information, please follow other related articles on the PHP Chinese website!