web3.0

web3.0 SEC approves Grayscale and ProShares Ethereum spot ETFs to be traded on NYSE Arca! Launched simultaneously on 7/23

SEC approves Grayscale and ProShares Ethereum spot ETFs to be traded on NYSE Arca! Launched simultaneously on 7/23

This site (120bTC.coM): When the Ethereum spot ETF will be listed has become the focus of most attention among crypto investors recently. Just earlier today (18th), documents disclosed by the U.S. Securities and Exchange Commission (SEC) on its official website showed that the SEC approved the 19b-4 documents (changes in trading rules) for two more Ethereum spot ETFs this morning.

They are: Grayscale Ethereum Mini Trust and ProShares’ Ethereum spot ETF, which have been approved to be listed on the Arca electronic trading platform of the New York Stock Exchange (NYSE).

However, before they are officially listed, they, like other 8 Ethereum spot ETFs that have previously been approved for 19b-4 documents, still have to wait for another key S-1 document (registration statement) to be approved by the SEC. Officially traded on the exchange.

Bloomberg Analyst: All Ethereum spot ETFs are expected to be launched at the same time next week

In response, Bloomberg ETF analyst James Seyffart expects these two ETFs to be launched at the same time as all other ETFs next week.

"This is a 19b-4 approval, which all other issuers already have, it just means that Grayscale Ether Mini Trust and Proshares Ether ETF will most likely launch at the same time as other funds. Signing of S-1 documents is still required, currently Not yet, expected next week.”

Earlier this week, Bloomberg’s senior ETF analysts and people familiar with the matter broke the news that the SEC has notified potential issuers that the Ethereum spot ETF will be approved and effective next Monday. It will be officially launched on the 23rd.

The fees of 9 Ethereum spot ETFs are released

At present, except for ProShares, the fees of other nine ETFs have been announced, and 7 of the 10 funds enjoy fee reductions.

According to the data table compiled by Seyffart:

BlackRock: code ETHA, fee is 0.25% (0.12% for the first 2.5 billion US dollars or the first 12 months)

Fidelity: code FETH , the fee is 0.25% (0% in 2024)

Bitwise: code ETHW, the fee is 0.20% (0% for the first 500 million US dollars or the first 6 months)

21Shares: code GETH, the fee is 0.21% (0% for the first $500 million or the first 6 months)

VanEck: Code ETHV, fee 0.20% (0% for the first 1.5 billion USD or the first 12 months)

Invescox Galaxy: Code QETH, fee 0.25%

Franklin: code EZET, fee 0.19% (0% before January 31, 2025 or the first 10 billion US dollars),

Grayscale Ethereum spot ETF: code ETHE, Fees are 2.50%

Grayscale Ethereum Spot Mini ETF: Symbol ETH, Fees are 0.25% (0.12% for first $2 billion or first 12 months)

The above is the detailed content of SEC approves Grayscale and ProShares Ethereum spot ETFs to be traded on NYSE Arca! Launched simultaneously on 7/23. For more information, please follow other related articles on the PHP Chinese website!

灰度已将近11.3万枚比特币转换为现货ETF,总价值超过45亿美元Jan 25, 2024 pm 09:15 PM

灰度已将近11.3万枚比特币转换为现货ETF,总价值超过45亿美元Jan 25, 2024 pm 09:15 PM根据最新ArkhamIntelligence数据显示,自11日以来,灰度GBTC经过成功转换成比特币现货ETF后,持续出现大额资金流出。据报道,近期灰度已从其钱包地址中转出近113,000枚比特币,其中绝大多数比特币被转移到CoinbasePrime,预计用于出售。这一情况表明投资者对比特币现货ETF的需求较高,并且他们正在利用这一机会进行大规模的交易活动。灰度的资金流出可能会对比特币市场产生一定的影响,因此值得密切关注。根据灰度官网数据显示,目前GBTC持有的比特币数量约为53.7万枚。自11

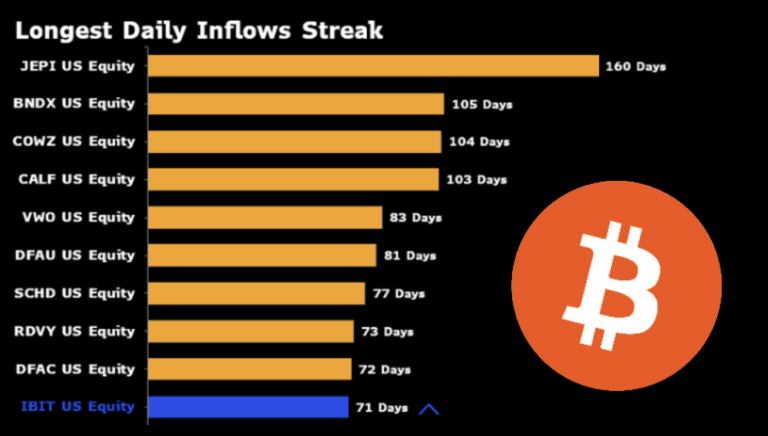

贝莱德IBIT止步连续净流入71天!灰度GBTC续创连续净流出记录Apr 26, 2024 pm 06:40 PM

贝莱德IBIT止步连续净流入71天!灰度GBTC续创连续净流出记录Apr 26, 2024 pm 06:40 PM根据彭博社ETF分析师EricBalchunas的统计,贝莱德比特币现货ETFIBIT在昨日未出现资金流入,故其每日连续流入的记录已终止在71天。而灰度的GBTC仍不断地在刷新记录,目前已连续72天净流出,无人能及。IBIT终止于第十强,连续净流入71天根据彭博社ETF分析师EricBalchunas的ETF连续净流入天数记录,贝莱德比特币现货ETFIBIT在昨日未出现资金流入,故其每日连续流入的记录已终止在71天。第一名是摩根大通股票溢价收入ETF(代码JEPI),于2020年发行,竟然有惊人

幻兽帕鲁在Steam上大热!以太坊和Solana的Meme币PALW与PAL登场Jan 27, 2024 pm 03:36 PM

幻兽帕鲁在Steam上大热!以太坊和Solana的Meme币PALW与PAL登场Jan 27, 2024 pm 03:36 PMPocketpair发布的Steam游戏《幻兽帕鲁》在1月19日开启抢先体验后迅速走红,并在首发24小时内突破了200万套的销量。游戏的同时在线人数也超过了129万,成为该平台上最畅销和最受欢迎的游戏。《幻兽帕鲁》Meme币现身以太坊、Solana在加密货币世界中,Meme币是非常独特的一类,许多Meme币都因知名IP的影响而诞生,并创造了百倍、千倍的财富神话。例如与特斯拉创办人马斯克(ElonMusk)有关的Doge、Shib、Troll等。同样,在《幻兽帕鲁》卖翻全球的背景下,其相关Meme

灰度拟发行迷你GBTC、业界最低管理费0.15%!能吸引资金流入?Apr 23, 2024 am 09:04 AM

灰度拟发行迷你GBTC、业界最低管理费0.15%!能吸引资金流入?Apr 23, 2024 am 09:04 AM本站(120bTC.coM):灰度在上月向美国证券交易委员会(SEC)提交申请,寻求发行管理费更低的迷你版灰度比特币现货ETF「BitcoinMiniTrust」(BTC),如今据灰度最新提交的预估财务报表,该ETF将收取0.15%管理费用,比当前所有比特币现货ETF都要低。灰度GBTC目前收取高达1.5%的管理费用,并持续出现资金净流出,根据最新文件,当迷你版GBTC推出时,灰度将把GBTC的10%资产注入该基金,迷你版GBTC的份额将自动发行、并分配给GBTC份额持有者。Coindesk报导

Google上架多个比特币现货ETF广告!贝莱德、富达、灰度已投放Jan 31, 2024 pm 04:03 PM

Google上架多个比特币现货ETF广告!贝莱德、富达、灰度已投放Jan 31, 2024 pm 04:03 PM本站(120bTC.coM):Web2科技巨头谷歌(Google)在去年12月曾预告,即将在2024年1月更新其加密货币相关产品的广告政策,将自2024年1月29日起正式开放广告商针对美国的「加密货币信托」产品进行广告。Google将加密货币信托定义为「允许投资者交易持有大量数字货币的信托股票的金融产品」,因此市场推测届时广告商将能够在Google平台推广符合此定义的「比特币现货ETF」。Google上架多个比特币现货ETF广告而在今(30)日,根据多个社群来源提供的截图显示,在搜寻栏输入“bi

消息人士透露:SEC计划否决以太坊现货ETFJan 24, 2024 pm 09:42 PM

消息人士透露:SEC计划否决以太坊现货ETFJan 24, 2024 pm 09:42 PM美国证券交易委员会(SEC)最近批准了11个比特币现货ETF,这让人们对以太坊现货ETF今年能否获批的乐观情绪升温。彭博的ETF分析师EricBalchunas表示,以太坊现货ETF在5月获批的可能性已上升至70%。当前有7档以太坊现货ETF正在等待SEC核准,申请人包括贝莱德(BlackRock)、富达(Fidelity)、灰度(Grayscale)、VanEck、方舟/21Shares、Invesco/Galaxy以及Hashdex。知情人士:SEC想「强行拒绝」批准以太坊现货ETF根据Fo

以太坊现货ETF第二天净流出1.33亿美元!灰度成罪魁祸首Jul 26, 2024 am 05:10 AM

以太坊现货ETF第二天净流出1.33亿美元!灰度成罪魁祸首Jul 26, 2024 am 05:10 AM本站(120btC.coM):随着以太坊现货ETF开市来到第二天,该市场出现了1.33亿美元的资金外流,主要原遭指因是灰度(Grayscale)以太坊信托基金(ETHE)的大量资金流失。同时,BTC在北京时间中午一度跌穿64k、ETH24小时跌幅更超过5%。以太坊现货ETF第二天净流出1.33亿美元FarsideInvesters数据指出,当前市面上九档以太坊现货ETF中,有八个在第二天实现了净资金流入。然而即便如此,整体市场仍有着1.333亿美元的净流出,逆转了周二原先1.066亿美元的净流入

FTX持续抛售近10亿美元灰度GBTC,引发比特币跌破4万的原因?Jan 24, 2024 pm 04:06 PM

FTX持续抛售近10亿美元灰度GBTC,引发比特币跌破4万的原因?Jan 24, 2024 pm 04:06 PM自美国证券交易委员会(SEC)批准比特币现货ETF以来,BTC价格从高点48,969美元开始持续下跌。截至今日凌晨,BTC已跌破4万大关,目前在39,750美元附近震荡。知情人士:FTX抛售近10亿美元GBTC目前市场普遍认为近日比特币的跌势,与灰度GBTC投资者,在负溢价趋近归零后大量获利了结有关。根据Coindesk的报道,昨日深夜,经过审查私人数据并采访两位知情人士,他们爆料称,大量抛售GBTC的人中包括FTX破产清算团队。这些人抛售了约2,200万股的GBTC股票,价值接近10亿美元,几

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Dreamweaver CS6

Visual web development tools

Zend Studio 13.0.1

Powerful PHP integrated development environment

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),

Atom editor mac version download

The most popular open source editor