How to play long and short positions in digital currency?

The digital currency market provides long and short trading opportunities, leading to greater profit potential. Go long: Expect prices to rise, buy and hold. Short selling: In anticipation of a price drop, borrow and sell immediately, and buy back to the exchange after the price drops. Trading strategies include technical analysis, fundamental analysis, leverage trading and hedging. Long and short trading carries a high level of risk and is suitable for experienced traders.

Guide to Long and Short Digital Currency

The digital currency market provides long and short trading opportunities, which presents traders with greater profit potential. Below is a guide on how to participate in long and short trading of digital currencies.

Go Long (Long)

- Meaning: In anticipation of an increase in the price of a digital currency, buy and hold the currency.

- Operation: Buy digital currency at the current market price and wait for its appreciation.

- Profit: When the price of digital currency rises and is higher than the buying price, traders can make profits.

- Risk: If digital currency prices fall, traders will suffer losses.

Short

- Meaning: Expect the price of a digital currency to fall, so borrow the currency and sell it immediately.

- Operation: Borrow digital currency from the exchange, sell it at the current market price, and then buy it back to the exchange after the price drops.

- Profit: Traders can make a profit when the price of a digital currency falls below the borrow price.

- Risk: If the price of a digital currency increases, traders will suffer losses because they need to buy at a higher price to repay the borrowed currency.

Trading Strategies

- Technical Analysis: Use charts and indicators to predict price movements.

- Fundamental Analysis: Consider news and events that impact digital currency prices.

- Leveraged Trading: Use borrowed funds to magnify potential gains, but be aware of the risks that come with leverage.

- Hedging: Using a short or long position to offset losses from another trade.

Points to note

- Long and short trading carries high risks and is suitable for experienced traders.

- Conduct thorough research and develop a clear trading plan before making a trade.

- Set stop-loss and take-profit orders to limit potential losses and lock in profits.

- When trading short, be sure to manage your risk as the potential for loss is unlimited.

- Choose a reputable cryptocurrency exchange for trading.

The above is the detailed content of How to play long and short positions in digital currency?. For more information, please follow other related articles on the PHP Chinese website!

amazon project kuiper satellite launchApr 10, 2025 pm 05:36 PM

amazon project kuiper satellite launchApr 10, 2025 pm 05:36 PMAmazon's Project Kuiper satellite launch was postponed due to unfavorable weather conditions. The delay was likely influenced by factors such as high-altitude wind shear, lightning threats, and high surface winds, which are common hazards in space launches. This postponement highlights the need for meticulous planning and flexibility in the unpredictable environment of space operations.

Is Wall Street Quietly Backing Solana? $42 Million Bet Says YesApr 10, 2025 pm 12:43 PM

Is Wall Street Quietly Backing Solana? $42 Million Bet Says YesApr 10, 2025 pm 12:43 PMA group of former Kraken executives acquired U.S.-listed company Janover, which secured $42 million in venture capital funding to begin building a Solana (SOL) treasury.

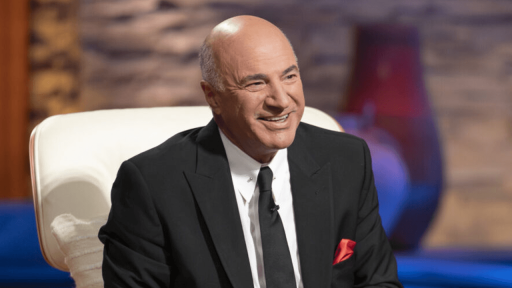

Kevin O'Leary Urges Trump to Impose 400% Tariff on Chinese GoodsApr 10, 2025 pm 12:35 PM

Kevin O'Leary Urges Trump to Impose 400% Tariff on Chinese GoodsApr 10, 2025 pm 12:35 PMCanadian businessman and investor Kevin O’Leary urged the Trump administration to impose a 400% tariff on Chinese goods, arguing that the current 104% tariff is insufficient to compel China to follow trade rules. O’Leary said these statements prior t

Regulatory roadblocks are crumbling as the U.S. Treasury signals a sweeping pivot toward blockchain, stablecoins, and digital assetsApr 10, 2025 pm 12:27 PM

Regulatory roadblocks are crumbling as the U.S. Treasury signals a sweeping pivot toward blockchain, stablecoins, and digital assetsApr 10, 2025 pm 12:27 PMU.S. Treasury Secretary Scott Bessent laid out a broad financial reform agenda at the Bankers Association Summit on April 9, pledging to remove regulatory barriers

China and Russia Have Started to Settle Some Trade Deals Using BitcoinApr 10, 2025 pm 12:19 PM

China and Russia Have Started to Settle Some Trade Deals Using BitcoinApr 10, 2025 pm 12:19 PMAccording to a report by VanEck, China and Russia have started to settle some trade deals using Bitcoin.

Skybridge Capital's founder warns China is preparing fierce economic retaliation as the U.S. slaps 125% tariffs on Chinese goods, signaling currency shocks, massive stimulus, and financial warfare.Apr 10, 2025 pm 12:03 PM

Skybridge Capital's founder warns China is preparing fierce economic retaliation as the U.S. slaps 125% tariffs on Chinese goods, signaling currency shocks, massive stimulus, and financial warfare.Apr 10, 2025 pm 12:03 PMucci Outlines 5-Point Forecast on China's Next Moves Amid Rising Trade Tensions

Ethereum (ETH) Underperforms Bitcoin (BTC)Apr 10, 2025 pm 12:01 PM

Ethereum (ETH) Underperforms Bitcoin (BTC)Apr 10, 2025 pm 12:01 PMunderperformed Bitcoin on 85% of all trading days since it launched in 2015. The ETH/BTC ratio, which tracks the value of Ether relative to Bitcoin, dropped to a five-year low of 0.018

President Trump's Tariff Announcement Sent Bitcoin Dropping 5.4%Apr 10, 2025 am 11:53 AM

President Trump's Tariff Announcement Sent Bitcoin Dropping 5.4%Apr 10, 2025 am 11:53 AMIn the world of cryptocurrencies, few events can shake things up like big government decisions. President Trump's recent tariff announcement did exactly that

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 Linux new version

SublimeText3 Linux latest version

Zend Studio 13.0.1

Powerful PHP integrated development environment

SublimeText3 Chinese version

Chinese version, very easy to use

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

mPDF

mPDF is a PHP library that can generate PDF files from UTF-8 encoded HTML. The original author, Ian Back, wrote mPDF to output PDF files "on the fly" from his website and handle different languages. It is slower than original scripts like HTML2FPDF and produces larger files when using Unicode fonts, but supports CSS styles etc. and has a lot of enhancements. Supports almost all languages, including RTL (Arabic and Hebrew) and CJK (Chinese, Japanese and Korean). Supports nested block-level elements (such as P, DIV),