Bitcoin's unpredictable nature has been a topic of intense discussion lately, with fluctuations causing both excitement and panic among investors.

Bitcoin's volatility has been a hot topic lately, with large price swings causing both excitement and panic among investors. In this roundtable discussion, we'll delve into these dynamics, hearing from Sam Price, Host of Crypto Lifer, and Claire Ching, Head of Institutional at Gemini, to gain insights into both retail and institutional perspectives.

Rob Nelson opened the discussion by addressing the common concerns among retail investors regarding bitcoin's volatility.

"We're seeing people panic when they see these large price swings, like bitcoin's recent dip from $73,000 to $64,000. It's an overreaction, but understandable given the unfamiliarity with such volatility," he remarked.

Sam Price shared his thoughts on why retail investors often panic during price drops.

"I think bitcoin creates these quick opportunities, and we're seeing it with the ETF and other market catalysts. It brings in a burst of activity, and then we see these corrections. Retail investors often have these unrealistic expectations, thinking their investments will go up steadily and not encounter any volatility," he explained.

"When it becomes a little rocky, their emotions get very strong, and we see them panicking and reacting quickly to these price drops," Price added.

Nelson went on to discuss the behavior of bitcoin holders, contrasting it with typical investment strategies.

"We're seeing a lot of people hold onto bitcoin for the long term, which is interesting because other types of investments, people tend to buy and sell more frequently. Bitcoin's kind of weird that so many people literally hold it and will never let it go," he said, highlighting the unique approach of bitcoin investors.

Ching provided an institutional perspective, discussing the broader market trends and the impact of meme coins.

"We're seeing a broader market trend where meme coins, which had a strong performance earlier, are now showing significant declines. For those of you tracking meme coin performance, it's absolutely just on the ground," she stated.

Ching suggested that the current market conditions might present a clean slate for investors to re-engage, as positions become more manageable after significant drawdowns.

The above is the detailed content of Retail Investors Panic as Bitcoin Volatility Spikes. For more information, please follow other related articles on the PHP Chinese website!

amazon project kuiper satellite launchApr 10, 2025 pm 05:36 PM

amazon project kuiper satellite launchApr 10, 2025 pm 05:36 PMAmazon's Project Kuiper satellite launch was postponed due to unfavorable weather conditions. The delay was likely influenced by factors such as high-altitude wind shear, lightning threats, and high surface winds, which are common hazards in space launches. This postponement highlights the need for meticulous planning and flexibility in the unpredictable environment of space operations.

Is Wall Street Quietly Backing Solana? $42 Million Bet Says YesApr 10, 2025 pm 12:43 PM

Is Wall Street Quietly Backing Solana? $42 Million Bet Says YesApr 10, 2025 pm 12:43 PMA group of former Kraken executives acquired U.S.-listed company Janover, which secured $42 million in venture capital funding to begin building a Solana (SOL) treasury.

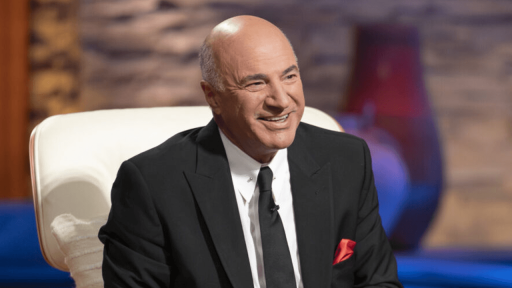

Kevin O'Leary Urges Trump to Impose 400% Tariff on Chinese GoodsApr 10, 2025 pm 12:35 PM

Kevin O'Leary Urges Trump to Impose 400% Tariff on Chinese GoodsApr 10, 2025 pm 12:35 PMCanadian businessman and investor Kevin O’Leary urged the Trump administration to impose a 400% tariff on Chinese goods, arguing that the current 104% tariff is insufficient to compel China to follow trade rules. O’Leary said these statements prior t

Regulatory roadblocks are crumbling as the U.S. Treasury signals a sweeping pivot toward blockchain, stablecoins, and digital assetsApr 10, 2025 pm 12:27 PM

Regulatory roadblocks are crumbling as the U.S. Treasury signals a sweeping pivot toward blockchain, stablecoins, and digital assetsApr 10, 2025 pm 12:27 PMU.S. Treasury Secretary Scott Bessent laid out a broad financial reform agenda at the Bankers Association Summit on April 9, pledging to remove regulatory barriers

China and Russia Have Started to Settle Some Trade Deals Using BitcoinApr 10, 2025 pm 12:19 PM

China and Russia Have Started to Settle Some Trade Deals Using BitcoinApr 10, 2025 pm 12:19 PMAccording to a report by VanEck, China and Russia have started to settle some trade deals using Bitcoin.

Skybridge Capital's founder warns China is preparing fierce economic retaliation as the U.S. slaps 125% tariffs on Chinese goods, signaling currency shocks, massive stimulus, and financial warfare.Apr 10, 2025 pm 12:03 PM

Skybridge Capital's founder warns China is preparing fierce economic retaliation as the U.S. slaps 125% tariffs on Chinese goods, signaling currency shocks, massive stimulus, and financial warfare.Apr 10, 2025 pm 12:03 PMucci Outlines 5-Point Forecast on China's Next Moves Amid Rising Trade Tensions

Ethereum (ETH) Underperforms Bitcoin (BTC)Apr 10, 2025 pm 12:01 PM

Ethereum (ETH) Underperforms Bitcoin (BTC)Apr 10, 2025 pm 12:01 PMunderperformed Bitcoin on 85% of all trading days since it launched in 2015. The ETH/BTC ratio, which tracks the value of Ether relative to Bitcoin, dropped to a five-year low of 0.018

President Trump's Tariff Announcement Sent Bitcoin Dropping 5.4%Apr 10, 2025 am 11:53 AM

President Trump's Tariff Announcement Sent Bitcoin Dropping 5.4%Apr 10, 2025 am 11:53 AMIn the world of cryptocurrencies, few events can shake things up like big government decisions. President Trump's recent tariff announcement did exactly that

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Notepad++7.3.1

Easy-to-use and free code editor

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment

SublimeText3 Chinese version

Chinese version, very easy to use

Atom editor mac version download

The most popular open source editor