The BTC Corruption Fear Index fell to its lowest level in 18 months. Has the 'big bottom” arrived?

- 王林Original

- 2024-07-18 07:43:30316browse

Federal Reserve Chairman Powell's positive remarks on an improving inflation outlook eased market nerves on Tuesday. After Powell's speech, traders bet on the probability of a rate cut in September rose to 73% from 68% last week, but this week consumers Caution remains ahead of the release of the Consumer Price Index (CPI) and Producer Price Index (PPI) reports.

Bit push data shows that the total market value of cryptocurrency increased by 2.5%, and Bitcoin’s long and short forces competed. The bulls pushed BTC all the way from US$56,700 to an intraday high of US$58,312. As of press time, the trading price of Bitcoin was US$57,804. , a 24-hour increase of 2.19%.

The altcoin market has largely rebounded, with around 90% of the top 200 coins by market capitalization posting gains.

Mog Coin (MOG) was the top gainer at about 18.1%, followed by Sei (SEI) up 17% and Celestia (TIA) up 16.8%. aelf (ELF) was the biggest loser, down 6%, Pepe (PEPE) fell 4.4%, and Axelar (AXL) fell 3.5%.

The current overall market value of cryptocurrency is US$2.12 trillion, and Bitcoin’s market share is 53.7%.

At the close of U.S. stocks, the S&P 500 index and the Nasdaq 500 index rose 0.07% and 0.14% respectively, while the Dow Jones index fell 0.13%.

Bitcoin Fear & Greed Index has fallen to its lowest level since January 2023

The BTC Fear & Greed Index, an indicator that tracks relative market sentiment, has fallen to its lowest level since January 2023, according to data from Glassnode level, falling to 27 on July 9.

Lower levels on the index indicate negative investor sentiment, while higher levels indicate a hot market and investors are afraid of missing out on profit opportunities.

January 2023 is just two months after the collapse of cryptocurrency exchange FTX. At the beginning of the month, the Cryptocurrency Fear and Greed Index was at 26, with Bitcoin trading around $16,500. It then rebounded to around $22,000 by the end of the month.

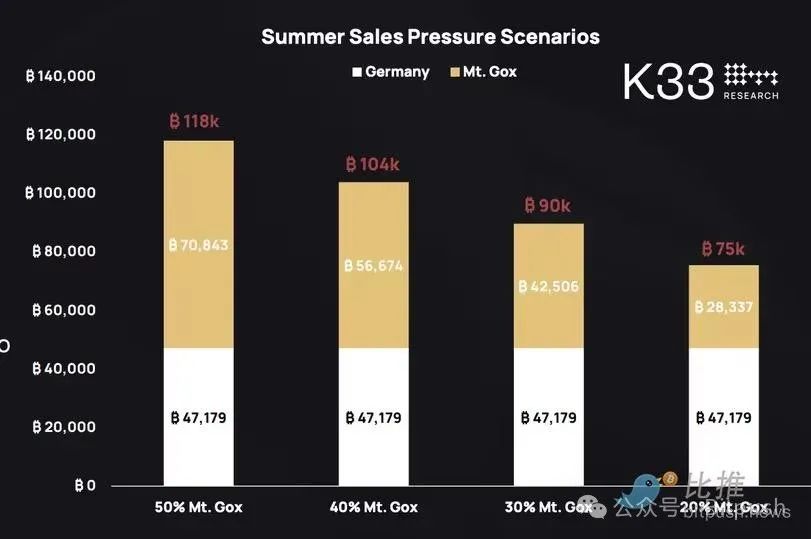

Some analysts believe that the recent correction may be attributed to panic caused by the German government’s sale of more than $3 billion worth of previously seized Bitcoin and the return of Mt. Gox’s claims. Mt. Gox's Bitcoin repayments are approaching $8 billion, although the timing remains uncertain and creditors may choose to hold on to them rather than sell them on the market. Meanwhile, more than 50% of the 50,000 bitcoins in German government wallets have been moved to exchanges as of July 9.

Markus Thielen, founder of 10x Research, said in a market update on Tuesday that BTC’s upward momentum may continue for a while and may reach $60,000, but this increase will be short-lived and no tactical bullish reversal is expected in the short term. The trend rebounded.

He added: "We expect Bitcoin to potentially recover to nearly $60,000 before falling again to the low $50,000s, creating a complex trading environment."

K33 Research senior analyst Vetle Lunde noted on Tuesday that seasonal trends are also It doesn't help that Bitcoin has historically seen its lowest returns in the third quarter.

Seasonal weakness combined with the German government’s sale of seized assets and the continued distribution of Mt. Gox refunds is weighing on prices, he added. These selling pressures are expected to have an impact in the coming months, with market volatility continuing into October, according to estimates from K33 Research.

Signs of a turnaround

As the market declines, technical and fundamental analysts have provided some ideas for the next move.

According to CryptoQuant analyst Crypto Dan, the Bitcoin Puell multiple is “generally suitable for finding the bottom of a bear market, but can also predict the end of a correction period in a bull market.”

He explained that the one circled in red in the chart above The area is a bull cycle where miner profitability declines rapidly and the Puell Multiple metric plummets, which fell sharply during the 2016 and 2020 bull cycles, before Bitcoin began a strong rise.

Crypto Dan said: “Currently, similar trends have been detected, and although it is difficult to determine the exact end of the adjustment period, it can be expected that it will not be too far away. We will most likely see a bull market within the third quarter of 2024 Recover.”

在比特幣最近跌破55,000 美元之後,加密市場分析師Crypto General 在X平台指出「雙底」模式正在形成,並預測短期內將反彈至64,000 美元,他認為,比特幣要想延續漲勢,就需要在4h50EMA 保持支撐,該水平目前接近58,000 美元。

The above is the detailed content of The BTC Corruption Fear Index fell to its lowest level in 18 months. Has the 'big bottom” arrived?. For more information, please follow other related articles on the PHP Chinese website!