web3.0

web3.0 US Spot Bitcoin ETFs Show Significant Recovery After July 4th Celebration, Record $437.9M in Net Inflows

US Spot Bitcoin ETFs Show Significant Recovery After July 4th Celebration, Record $437.9M in Net InflowsUS spot Bitcoin ETFs, the catalyst for the recent cryptocurrency market bull run, have shown significant recovery from past Friday to yesterday's trading.

After the launch of the first US spot Bitcoin ETFs in February, these financial instruments have sparked a bull run in the cryptocurrency market. From July 4th to 5th, the issuers of these ETFs already recorded a net flow of $437.9 million from the investors’ buying spree.

To break down the numbers, the US spot Bitcoin ETFs experienced a total net inflow of $143.1 million on Friday. The figures were then amplified on Monday with $294.8 million in overall net inflows.

Based on Farside Investor’s data, Fidelity Wise Origin Bitcoin Fund (FBTC) and Blackrock’s iShares Bitcoin Trust (IBIT) were among the major contributors to the inflows. The former logged a net inflow of $117.4 million on Friday, while the latter gained $187.2 million in net inflows on Monday.

Meanwhile, Grayscale Bitcoin Trust (BTC), which dumped most of its shares in its bid for a spot ETF conversion, began with a negative net flow of $28.6 million on July 5 but eventually recovered with $25.1 million at the start of this week.

Biggest Gainer and Loser

Blackrock’s IBIT remains the biggest gainer since its approval by the US Securities and Exchange Commission (SEC). The giant investment manager helmed by CEO Larry Fink has a total net inflow of $17.926 billion from its launch on January 11 to the present.

Blackrock also held the record for having the most net inflows within a single day at a whopping $849 million, which it achieved on March 12 this year. Its worst performance came with a negative flow of $36.9 million on May 1. These resulted in the company’s daily average of $146.9 million.

Fidelity’s IBTC comes second with $9.422 billion in net inflows. Grayscale, on the other hand, had its inflows countered by $18.578 billion outflows within this period.

Grayscale’s worst performance was on March 18 when its shares recorded a negative flow of $642.5 million. The crypto asset manager’s highest was on May 3 when it finally broke its losing streak with $63 million in net inflows. However, its daily average flow sits at a negative $152.3 million.

Bitcoin Today

As of 8:30 AM UTC on Tuesday, Bitcoin continues its struggle to regain the $60K mark at $57.7K due to the selling pressure recently caused by Mt. Gox’s repayments to its creditors and the German government’s continuous whale transfers.

It should be noted that the wallet traced to the German government once again moved a total of 3,100 BTC valued at $177.54 to two associated anonymous addresses and Kraken crypto exchange this morning.

The above is the detailed content of US Spot Bitcoin ETFs Show Significant Recovery After July 4th Celebration, Record $437.9M in Net Inflows. For more information, please follow other related articles on the PHP Chinese website!

amazon project kuiper satellite launchApr 10, 2025 pm 05:36 PM

amazon project kuiper satellite launchApr 10, 2025 pm 05:36 PMAmazon's Project Kuiper satellite launch was postponed due to unfavorable weather conditions. The delay was likely influenced by factors such as high-altitude wind shear, lightning threats, and high surface winds, which are common hazards in space launches. This postponement highlights the need for meticulous planning and flexibility in the unpredictable environment of space operations.

Is Wall Street Quietly Backing Solana? $42 Million Bet Says YesApr 10, 2025 pm 12:43 PM

Is Wall Street Quietly Backing Solana? $42 Million Bet Says YesApr 10, 2025 pm 12:43 PMA group of former Kraken executives acquired U.S.-listed company Janover, which secured $42 million in venture capital funding to begin building a Solana (SOL) treasury.

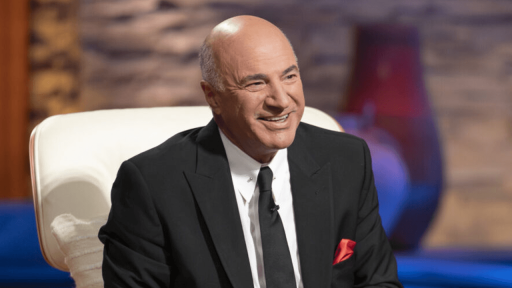

Kevin O'Leary Urges Trump to Impose 400% Tariff on Chinese GoodsApr 10, 2025 pm 12:35 PM

Kevin O'Leary Urges Trump to Impose 400% Tariff on Chinese GoodsApr 10, 2025 pm 12:35 PMCanadian businessman and investor Kevin O’Leary urged the Trump administration to impose a 400% tariff on Chinese goods, arguing that the current 104% tariff is insufficient to compel China to follow trade rules. O’Leary said these statements prior t

Regulatory roadblocks are crumbling as the U.S. Treasury signals a sweeping pivot toward blockchain, stablecoins, and digital assetsApr 10, 2025 pm 12:27 PM

Regulatory roadblocks are crumbling as the U.S. Treasury signals a sweeping pivot toward blockchain, stablecoins, and digital assetsApr 10, 2025 pm 12:27 PMU.S. Treasury Secretary Scott Bessent laid out a broad financial reform agenda at the Bankers Association Summit on April 9, pledging to remove regulatory barriers

China and Russia Have Started to Settle Some Trade Deals Using BitcoinApr 10, 2025 pm 12:19 PM

China and Russia Have Started to Settle Some Trade Deals Using BitcoinApr 10, 2025 pm 12:19 PMAccording to a report by VanEck, China and Russia have started to settle some trade deals using Bitcoin.

Skybridge Capital's founder warns China is preparing fierce economic retaliation as the U.S. slaps 125% tariffs on Chinese goods, signaling currency shocks, massive stimulus, and financial warfare.Apr 10, 2025 pm 12:03 PM

Skybridge Capital's founder warns China is preparing fierce economic retaliation as the U.S. slaps 125% tariffs on Chinese goods, signaling currency shocks, massive stimulus, and financial warfare.Apr 10, 2025 pm 12:03 PMucci Outlines 5-Point Forecast on China's Next Moves Amid Rising Trade Tensions

Ethereum (ETH) Underperforms Bitcoin (BTC)Apr 10, 2025 pm 12:01 PM

Ethereum (ETH) Underperforms Bitcoin (BTC)Apr 10, 2025 pm 12:01 PMunderperformed Bitcoin on 85% of all trading days since it launched in 2015. The ETH/BTC ratio, which tracks the value of Ether relative to Bitcoin, dropped to a five-year low of 0.018

President Trump's Tariff Announcement Sent Bitcoin Dropping 5.4%Apr 10, 2025 am 11:53 AM

President Trump's Tariff Announcement Sent Bitcoin Dropping 5.4%Apr 10, 2025 am 11:53 AMIn the world of cryptocurrencies, few events can shake things up like big government decisions. President Trump's recent tariff announcement did exactly that

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

Notepad++7.3.1

Easy-to-use and free code editor

Dreamweaver CS6

Visual web development tools

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool