web3.0

web3.0 Ordi (ORDI), Bitcoin SV (BSV), and 1000SATS (SATS) Price Analysis and Prediction: What\'s Next for These BRC-20 Tokens in July?

Ordi (ORDI), Bitcoin SV (BSV), and 1000SATS (SATS) Price Analysis and Prediction: What\'s Next for These BRC-20 Tokens in July?With the Bitcoin (BTC) price failing to hold its value above the $55000 mark, the cryptocurrency market has recorded a correction of approximately 8% in valuation within the past 24 hours.

The cryptocurrency market has recorded a correction of approximately 8% in valuation within the past 24 hours, as the Bitcoin (BTC) price failed to hold its value above the $55,000 mark. Top tokens have also recorded a loss in valuation, plunging below their respective crucial support levels.

Following suit, the BRC-20 tokens have recorded a similar trend by erasing significant valuation from their respective portfolios. Top BRC-20 tokens such as ORDI and SATS have each recorded a loss of 17.38% and 26.71% over the past day.

If you're interested in learning more about the market sentiments and price analysis of Ordi (ORDI), Bitcoin SV (BSV), and 1000SATS (SATS), as well as their potential targets for July, continue reading below to find out.

Ordi (ORDI) Price Analysis For July

With the ongoing crypto market correction, the Ordi price has corrected by over 17% in valuation. The 24-hour trading volume has hit $278.177 Million, showcasing a change of +92.42%. Moreover, the altcoin has plunged 64.60% this year, highlighting a long-term bearish sentiment.

The technical indicator, MACD, displays a rising red histogram, indicating an increase in the selling-over-buying pressure in the crypto space. Furthermore, the averages show increased bearish sentiment, suggesting the price will continue this week.

If the market holds the ORDI coin price above its crucial support level of $28.25, the bulls will regain momentum and prepare to test its upper resistance level of $50.75 in the coming time. Conversely, if the bears continue to dominate, the ORDI price will test its low of $17.80.

SATS (1000SATS) Price Analysis For July

Following in the footsteps of the category leader, the second-largest BRC-20 token by market cap, the SATS price has plunged over 27% within the past day and 62.82% over the past month. Further, the 1000SATS price has erased 84.76% this year, indicating a strong bearish sentiment.

The MACD has recorded a constant flatline in its histogram, highlighting a weak price action for the altcoin in the market. Furthermore, the averages display a neutral trend, suggesting uncertainty in future price action.

Moreover, the SMA indicator constantly acts as a resistance to the SATS price chart in the 1D time frame, suggesting a bearish sentiment for the altcoin in the cryptocurrency space.

The above is the detailed content of Ordi (ORDI), Bitcoin SV (BSV), and 1000SATS (SATS) Price Analysis and Prediction: What\'s Next for These BRC-20 Tokens in July?. For more information, please follow other related articles on the PHP Chinese website!

amazon project kuiper satellite launchApr 10, 2025 pm 05:36 PM

amazon project kuiper satellite launchApr 10, 2025 pm 05:36 PMAmazon's Project Kuiper satellite launch was postponed due to unfavorable weather conditions. The delay was likely influenced by factors such as high-altitude wind shear, lightning threats, and high surface winds, which are common hazards in space launches. This postponement highlights the need for meticulous planning and flexibility in the unpredictable environment of space operations.

Is Wall Street Quietly Backing Solana? $42 Million Bet Says YesApr 10, 2025 pm 12:43 PM

Is Wall Street Quietly Backing Solana? $42 Million Bet Says YesApr 10, 2025 pm 12:43 PMA group of former Kraken executives acquired U.S.-listed company Janover, which secured $42 million in venture capital funding to begin building a Solana (SOL) treasury.

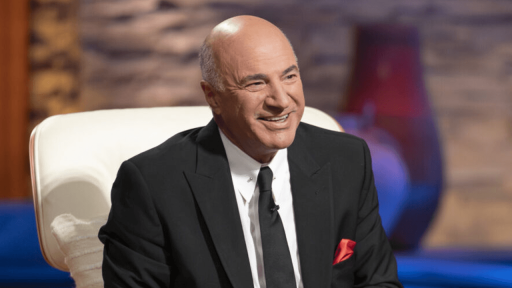

Kevin O'Leary Urges Trump to Impose 400% Tariff on Chinese GoodsApr 10, 2025 pm 12:35 PM

Kevin O'Leary Urges Trump to Impose 400% Tariff on Chinese GoodsApr 10, 2025 pm 12:35 PMCanadian businessman and investor Kevin O’Leary urged the Trump administration to impose a 400% tariff on Chinese goods, arguing that the current 104% tariff is insufficient to compel China to follow trade rules. O’Leary said these statements prior t

Regulatory roadblocks are crumbling as the U.S. Treasury signals a sweeping pivot toward blockchain, stablecoins, and digital assetsApr 10, 2025 pm 12:27 PM

Regulatory roadblocks are crumbling as the U.S. Treasury signals a sweeping pivot toward blockchain, stablecoins, and digital assetsApr 10, 2025 pm 12:27 PMU.S. Treasury Secretary Scott Bessent laid out a broad financial reform agenda at the Bankers Association Summit on April 9, pledging to remove regulatory barriers

China and Russia Have Started to Settle Some Trade Deals Using BitcoinApr 10, 2025 pm 12:19 PM

China and Russia Have Started to Settle Some Trade Deals Using BitcoinApr 10, 2025 pm 12:19 PMAccording to a report by VanEck, China and Russia have started to settle some trade deals using Bitcoin.

Skybridge Capital's founder warns China is preparing fierce economic retaliation as the U.S. slaps 125% tariffs on Chinese goods, signaling currency shocks, massive stimulus, and financial warfare.Apr 10, 2025 pm 12:03 PM

Skybridge Capital's founder warns China is preparing fierce economic retaliation as the U.S. slaps 125% tariffs on Chinese goods, signaling currency shocks, massive stimulus, and financial warfare.Apr 10, 2025 pm 12:03 PMucci Outlines 5-Point Forecast on China's Next Moves Amid Rising Trade Tensions

Ethereum (ETH) Underperforms Bitcoin (BTC)Apr 10, 2025 pm 12:01 PM

Ethereum (ETH) Underperforms Bitcoin (BTC)Apr 10, 2025 pm 12:01 PMunderperformed Bitcoin on 85% of all trading days since it launched in 2015. The ETH/BTC ratio, which tracks the value of Ether relative to Bitcoin, dropped to a five-year low of 0.018

President Trump's Tariff Announcement Sent Bitcoin Dropping 5.4%Apr 10, 2025 am 11:53 AM

President Trump's Tariff Announcement Sent Bitcoin Dropping 5.4%Apr 10, 2025 am 11:53 AMIn the world of cryptocurrencies, few events can shake things up like big government decisions. President Trump's recent tariff announcement did exactly that

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

Atom editor mac version download

The most popular open source editor

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

Zend Studio 13.0.1

Powerful PHP integrated development environment

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

ZendStudio 13.5.1 Mac

Powerful PHP integrated development environment