(Bloomberg) — Bitcoin is under renewed pressure amid concerns about potential sales of the token by creditors of the bankrupt Mt. Gox exchange, which has begun handing back a stash of about $8 billion of the largest digital asset.

Bitcoin fell as much as 5.2% on Monday amid concerns about potential sales of the token by creditors of the bankrupt Mt. Gox exchange, which has begun handing back a stash of about $8 billion of the largest digital asset.

Most cryptocurrency creditors of Mt. Gox, once the world’s largest Bitcoin exchange, are set to receive their first installment of tokens this week as part of a long-awaited, phased return of tokens to creditors. The exchange was hacked in 2011 and went bankrupt in 2014.

Bitcoin dropped to as low as $53,184 during Asian trading hours, and was trading at $55,290 at 12:13 p.m. in Singapore time, some $19,000 below its March high. Smaller tokens like Ether and XRP also fell.

Sentiment was also negatively affected by signs that the German government would be disposing of seized Bitcoins. At the same time, global markets are cautious as investors digest the results of the French parliamentary elections over the weekend.

Bitcoin’s 25% drop from its all-time high in the first quarter has left some speculators searching charts for patterns that could signal an end to the slide. Tony Sycamore, market analyst at IG Australia Pty, flagged the 200-day moving average. A sustained rise above that level would signal that Friday’s intraday low of around $53,600 was a “capitulation,” he wrote in his note.

If Bitcoin’s pullback continues through Sunday, the token would have fallen for five straight weeks, the longest losing streak since the digital asset bear market of 2022. There is a risk of a “grind lower” in prices until the Federal Reserve begins to ease monetary policy, said Stefan von Haenisch, head of trading at OSK SG Pte.

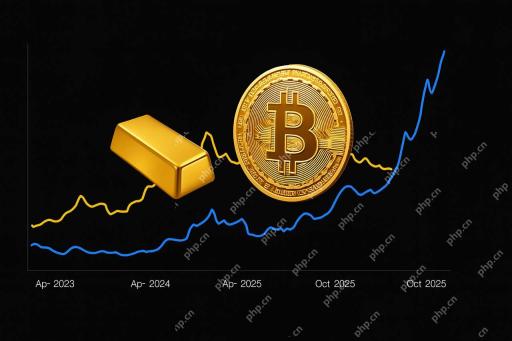

Earlier in 2024, bitcoin’s year-to-date gains approached 70%, far outpacing traditional assets like stocks. Now, the tech-heavy Nasdaq 100 index is closer to overtaking the falling token. Selloffs typically interrupt bitcoin bull markets, and the longer-term outlook remains positive, said Khushboo Khullar, venture partner at Lightning Ventures, which invests in bitcoin-linked companies.

Surprisingly strong demand for inaugural U.S. bitcoin exchange-traded funds fueled the digital asset’s record-breaking rise earlier this year. Inflows have moderated since then, and one question is whether the current weakness will deter ETF investors. But on Friday, they at least appeared to be buying the dip, recording the strongest net inflows in about a month.

The Mt. Gox spread is unlikely to lead to mass selling by creditors, but the longer Bitcoin stays below $60,000, the greater the chance of a further price correction, said Hayden Hughes, head of crypto investments at family office Evergreen Growth in Singapore.

Some investors are viewing Bitcoin’s dip as temporary, with the highest concentration of bullish bets around a $100,000 strike price, according to Deribit data. This could reflect expectations of looser monetary policy from the Fed in the coming months and the momentum behind pro-crypto Donald Trump’s bid for re-election to the US presidency.

Caroline Mauron, co-founder of Orbit Markets, a liquidity provider for digital asset derivatives, expects cryptocurrencies to be guided by global markets ahead of Fed Chair Jerome Powell’s testimony and U.S. inflation data, which are expected this week and could impact monetary policy forecasts.

The above is the detailed content of Bitcoin Falls Under $56,000 Amid Mt. Gox Exchange Woes. For more information, please follow other related articles on the PHP Chinese website!

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PM

Meme Coins' Hot Streak Cooled Dramatically in Q1 2025Apr 18, 2025 pm 12:24 PMThis sharp drop happened as investor interest faded and a major scandal hit the highly speculative market.

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PM

We Tend to Think Coin Flips Are Unfair When We LoseApr 18, 2025 pm 12:22 PMDespite being pretty much the iconic example of “random” – well, that and dice rolls – we can't help but feel like there's some element of skill involved. Especially when we lose.

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AM

Bitwise Announces the Listing of Four of Its Crypto ETPs on the London Stock Exchange (LSE)Apr 18, 2025 am 11:24 AMBitwise, a leading digital asset manager, has announced the listing of four of its crypto Exchange-Traded Products (ETPs) on the London Stock Exchange (LSE).

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AM

Bitcoin Set to Explode After Gold's Rally: Here's When BTC Could Break All-Time HighsApr 18, 2025 am 11:22 AMBitcoin may be poised for a massive rally—but only if gold continues its upward climb, according to Joe Consorti, Head of Growth at Theya.

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AM

Shiba Inu (SHIB) Price Prediction 2025: Targeting $0.0000399 By Year-EndApr 18, 2025 am 11:20 AMThe Shiba Inu price continues to attract the attention of analysts, who are watching for its next potential move. By Samuele Piar. Updated April 14, 2025.

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AM

Ripple and U.S. Securities and Exchange Commission (SEC) Agree to Hold the Appeal in AbeyanceApr 18, 2025 am 11:18 AMThe joint motion of Ripple and U.S. Securities and Exchange Commission (SEC) to hold the appeal in abeyance has been granted by the Circuit Judge Jose A. Cabranes.

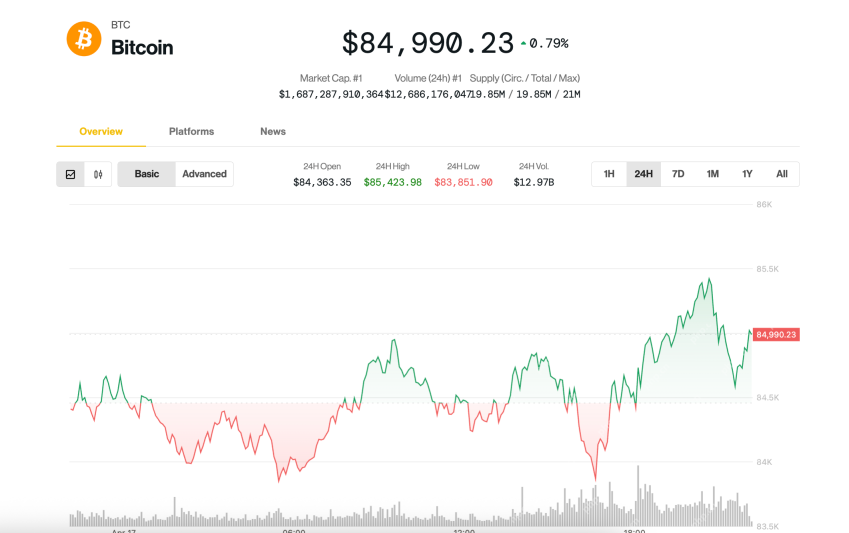

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AM

Bitcoin (BTC) was treading water just below $85,000Apr 18, 2025 am 11:14 AMBitcoin (BTC) was treading water just below $85,000 late Thursday as tensions between U.S. President Donald Trump and Federal Reserve Chair Jerome Powell added another layer of uncertainty for investors.

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AM

AB DAO Launches Dual Reward Campaign in Collaboration with Bitget to Celebrate Its Token Generation EventApr 18, 2025 am 11:12 AMToday, AB DAO officially announced the launch of a dual reward campaign in collaboration with Bitget (bitget.com), the world's second-largest digital asset trading platform.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

SublimeText3 Chinese version

Chinese version, very easy to use

Zend Studio 13.0.1

Powerful PHP integrated development environment

Atom editor mac version download

The most popular open source editor

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.