web3.0

web3.0 Circle becomes the first global stablecoin issuer to achieve compliance with the European Union\'s (EU) Markets in Crypto Asset (MiCA) policies

Circle becomes the first global stablecoin issuer to achieve compliance with the European Union\'s (EU) Markets in Crypto Asset (MiCA) policiesStablecoin issuer Circle is the first stablecoin company to achieve compliance with the European Union's (EU) Markets in Crypto Asset (MiCA)

Stablecoin issuer Circle has become the first company to achieve compliance with the European Union’s (EU) Markets in Crypto Asset (MiCA) policies designed to oversee digital asset business operations. Having obtained an Electronic Money Institution (EMI) license from French regulators, CEO Jeremy Allaire said Circle Mint France will manage EURC and USDC issuance for European users.

“Today, Circle announces that USDC and EURC are now available under new EU stablecoin laws,” the announcement reads. “Circle is the first global stablecoin issuer to be compliant with MiCA. Circle is now natively issuing both USDC and EURC to European customers, effective July 1st.”

Stablecoins offer an avenue to trade in and out of cryptocurrencies without suffering from the volatility associated with most digital assets, such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). Assets like Tether’s USDT and USDC are pegged to a sovereign currency, like the U.S. dollar or the euro.

The development comes amid uncertainty surrounding stablecoins in the EU, with MiCA promising to install strict rules on how these assets may be used. For instance, under the bloc’s framework, firms have a daily issuance limit of $215 million in transaction value.

Is Circle set to upend Tether?Circle's EMI license and MiCA compliance could claim European market share and even challenge crypto's largest stablecoin issuer, Tether.

Speculation circulated about Tether's European future after some platforms, like Bitstamp, delisted the firm's euro-denominated offering, Tether EURT. Uphold also closed support for USDT and several other dollar-pegged stabelcoins.

With a vacuum emerging and Circle boasting the first MiCA stablecoin license, Allaire and his company could flip Tether and USDT as the dominant stablecoin in multiple jurisdictions. The USDC issuer also plans to redomicile its legal base from Ireland to the U.S. before an initial public offering (IPO). Looming U.S. stablecoin regulations might solidify the company as a global stablecoin powerhouse.

However, USDC still has an uphill battle to catch up to Tether in terms of market capitalization. USDT holds the number one spot with $113 billion to USDC’s $32 billion. At press time, USDC is down from its June 2022 peak of around $55 billion.

The above is the detailed content of Circle becomes the first global stablecoin issuer to achieve compliance with the European Union\'s (EU) Markets in Crypto Asset (MiCA) policies. For more information, please follow other related articles on the PHP Chinese website!

amazon project kuiper satellite launchApr 10, 2025 pm 05:36 PM

amazon project kuiper satellite launchApr 10, 2025 pm 05:36 PMAmazon's Project Kuiper satellite launch was postponed due to unfavorable weather conditions. The delay was likely influenced by factors such as high-altitude wind shear, lightning threats, and high surface winds, which are common hazards in space launches. This postponement highlights the need for meticulous planning and flexibility in the unpredictable environment of space operations.

Is Wall Street Quietly Backing Solana? $42 Million Bet Says YesApr 10, 2025 pm 12:43 PM

Is Wall Street Quietly Backing Solana? $42 Million Bet Says YesApr 10, 2025 pm 12:43 PMA group of former Kraken executives acquired U.S.-listed company Janover, which secured $42 million in venture capital funding to begin building a Solana (SOL) treasury.

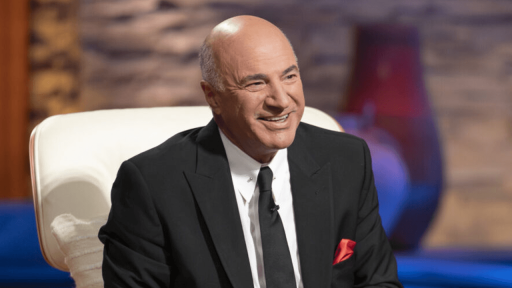

Kevin O'Leary Urges Trump to Impose 400% Tariff on Chinese GoodsApr 10, 2025 pm 12:35 PM

Kevin O'Leary Urges Trump to Impose 400% Tariff on Chinese GoodsApr 10, 2025 pm 12:35 PMCanadian businessman and investor Kevin O’Leary urged the Trump administration to impose a 400% tariff on Chinese goods, arguing that the current 104% tariff is insufficient to compel China to follow trade rules. O’Leary said these statements prior t

Regulatory roadblocks are crumbling as the U.S. Treasury signals a sweeping pivot toward blockchain, stablecoins, and digital assetsApr 10, 2025 pm 12:27 PM

Regulatory roadblocks are crumbling as the U.S. Treasury signals a sweeping pivot toward blockchain, stablecoins, and digital assetsApr 10, 2025 pm 12:27 PMU.S. Treasury Secretary Scott Bessent laid out a broad financial reform agenda at the Bankers Association Summit on April 9, pledging to remove regulatory barriers

China and Russia Have Started to Settle Some Trade Deals Using BitcoinApr 10, 2025 pm 12:19 PM

China and Russia Have Started to Settle Some Trade Deals Using BitcoinApr 10, 2025 pm 12:19 PMAccording to a report by VanEck, China and Russia have started to settle some trade deals using Bitcoin.

Skybridge Capital's founder warns China is preparing fierce economic retaliation as the U.S. slaps 125% tariffs on Chinese goods, signaling currency shocks, massive stimulus, and financial warfare.Apr 10, 2025 pm 12:03 PM

Skybridge Capital's founder warns China is preparing fierce economic retaliation as the U.S. slaps 125% tariffs on Chinese goods, signaling currency shocks, massive stimulus, and financial warfare.Apr 10, 2025 pm 12:03 PMucci Outlines 5-Point Forecast on China's Next Moves Amid Rising Trade Tensions

Ethereum (ETH) Underperforms Bitcoin (BTC)Apr 10, 2025 pm 12:01 PM

Ethereum (ETH) Underperforms Bitcoin (BTC)Apr 10, 2025 pm 12:01 PMunderperformed Bitcoin on 85% of all trading days since it launched in 2015. The ETH/BTC ratio, which tracks the value of Ether relative to Bitcoin, dropped to a five-year low of 0.018

President Trump's Tariff Announcement Sent Bitcoin Dropping 5.4%Apr 10, 2025 am 11:53 AM

President Trump's Tariff Announcement Sent Bitcoin Dropping 5.4%Apr 10, 2025 am 11:53 AMIn the world of cryptocurrencies, few events can shake things up like big government decisions. President Trump's recent tariff announcement did exactly that

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 English version

Recommended: Win version, supports code prompts!

Atom editor mac version download

The most popular open source editor

WebStorm Mac version

Useful JavaScript development tools

VSCode Windows 64-bit Download

A free and powerful IDE editor launched by Microsoft

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.