Technology peripherals

Technology peripherals It Industry

It Industry TrendForce: NAND flash memory product contract price growth is expected to narrow to 5~10% in the third quarter

TrendForce: NAND flash memory product contract price growth is expected to narrow to 5~10% in the third quarterAccording to news from this website on June 28, TrendForce released its latest research report today, predicting that the overall increase in NAND flash memory product contract prices in the third quarter will narrow to 5~10% from 15~20% in the second quarter. TrendForce said that several major original manufacturers will actively increase production in the second half of the year; enterprise-level solid-state drives will benefit from the rebound in server orders, and demand will grow steadily. However, demand in the consumer electronics field continues to be sluggish, resulting in a more obvious oversupply of NAND, which is also the main reason for the decrease in growth.

▲ Image source TrendForce TrendForce’s website is organized by category. TrendForce’s predictions are as follows:

3D NAND flash memory wafer

Due to the supply callback and the buyer’s unwillingness to purchase, the spot price of flash memory wafers has fallen below the contract price Eighty percent. Therefore, the contract price of flash memory wafers will basically not increase in the third quarter.

Consumer-grade solid-state drives

Although notebook sales are about to enter the peak season, notebook manufacturers are still relatively conservative in stocking up.

Original factory capacity upgrades have brought about increased supply and PC manufacturers have expanded the use of QLC SSDs. Two factors have intensified price competition. In the third quarter, the contract price increase of consumer-grade SSDs will only be 2~8%.

Enterprise-grade solid-state drives

Technology companies continue to expand spending on the construction of AI servers and traditional servers, resulting in a significant rebound in orders from server OEM manufacturers in the third quarter, driving the procurement demand for enterprise-grade solid-state drives to further increase compared with this quarter.

However, due to the overall oversupply of NAND flash memory, major suppliers are actively competing for enterprise-level SSD orders to reduce inventory in the second half of the year, suppressing the price increase. It is estimated that the increase in enterprise-level SSDs in the third quarter will decrease by about 5% to 15~20% .

UFS Flash Memory

Currently, smartphone manufacturers still hold enough UFS flash memory, the inventory level is declining slowly, and module manufacturers are gradually joining the UFS supply. This has curbed the momentum of flash memory original manufacturers to increase UFS prices significantly again in the third quarter. , the final quarter growth is expected to be between 3% and 8%.

eMMC Flash Memory

Several major original manufacturers have a clear attitude towards the price increase of eMMC flash memory. However, the demand for eMMC in the third quarter is still limited, and the final price increase will not be very large, and the contract price will remain roughly unchanged.

The above is the detailed content of TrendForce: NAND flash memory product contract price growth is expected to narrow to 5~10% in the third quarter. For more information, please follow other related articles on the PHP Chinese website!

修复:在 Windows 11 上格式化时出现 Rufus 错误Apr 28, 2023 pm 05:28 PM

修复:在 Windows 11 上格式化时出现 Rufus 错误Apr 28, 2023 pm 05:28 PMRufus是创建可启动安装媒体的绝佳工具,许多人使用它在他们的PC上执行Windows的全新安装。但是,许多用户在Windows11上报告了Rufus错误。这些错误将阻止您创建安装媒体,从而阻止您安装Windows11或任何其他操作系统。幸运的是,解决这些问题相对简单,在今天的教程中,我们将向您展示可用于解决此问题的最佳方法。为什么在Rufus中格式化时出现未确定的错误在Windows11上?造成这种情况的原因有很多,在大多数情况下,这只是导致此问题的软件故障。您可以通

在 Windows 11 上安装 BalenaEtcher 的命令Apr 19, 2023 pm 05:46 PM

在 Windows 11 上安装 BalenaEtcher 的命令Apr 19, 2023 pm 05:46 PM在Windows11上安装BalenaEtcher的步骤在这里,我们将展示无需访问其官方网站即可在Windows11上安装BalenaEthcer的快速方法。1.打开命令终端(以管理员身份)右键单击“开始”按钮并选择“终端” ( Admin )。这将打开具有管理权限的Windows终端,以安装软件并以超级用户身份执行其他重要任务。2.在Windows11上安装BalenaEtcher现在,在您的Windows终端上,只需运行使用默认Windows包管理器

业界最高 3.6GB/s 传输速率,美光宣布第九代 276 层 TLC NAND 闪存量产Jul 31, 2024 am 08:05 AM

业界最高 3.6GB/s 传输速率,美光宣布第九代 276 层 TLC NAND 闪存量产Jul 31, 2024 am 08:05 AM本站7月30日消息,美光当地时间今日宣布,其第九代(本站注:276层)3DTLCNAND闪存量产出货。美光表示其G9NAND拥有业界最高的3.6GB/sI/O传输速率(即3600MT/s闪存接口速率),较2400MT/s的现有竞品高出50%,能更好满足数据密集型工作负载对高吞吐量的需求。同时美光的G9NAND在写入带宽和读取带宽方面比市场上的其他解决方案分别高出99%和88%,这一NAND颗粒层面的优势将为固态硬盘和嵌入式存储方案带来性能与能效的提升。此外,与前代美光NAND闪存一样,美光276

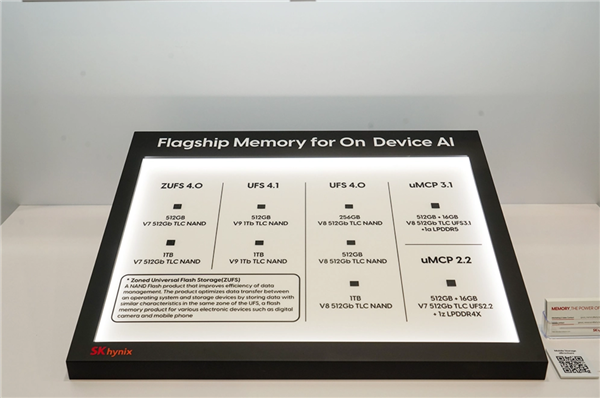

海力士抢先展示UFS 4.1闪存:基于V9 TLC NAND颗粒打造Aug 09, 2024 pm 03:33 PM

海力士抢先展示UFS 4.1闪存:基于V9 TLC NAND颗粒打造Aug 09, 2024 pm 03:33 PM8月9日消息,在FMS2024峰会上,SK海力士展示了其最新的存储产品,包括尚未正式发布规范的UFS4.1通用闪存。据JEDEC固态技术协会官网信息,目前公布的最新UFS规范是2022年8月的UFS4.0,其理论接口速度高达46.4Gbps,预计UFS4.1将在传输速率上实现进一步的提升。1.海力士展示了512GB和1TBUFS4.1通用闪存产品,基于321层V91TbTLCNAND闪存。SK海力士还展出了3.2GbpsV92TbQLC和3.6GbpsV9H1TbTLC颗粒。海力士展示了基于V7

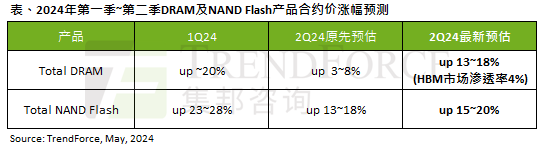

AI 潮影响明显,TrendForce 上修本季度 DRAM 内存、NAND 闪存合约价涨幅预测May 07, 2024 pm 09:58 PM

AI 潮影响明显,TrendForce 上修本季度 DRAM 内存、NAND 闪存合约价涨幅预测May 07, 2024 pm 09:58 PM根据TrendForce的调查报告显示,AI浪潮对DRAM内存和NAND闪存市场带来明显影响。在本站5月7日消息中,TrendForce集邦咨询在今日的最新研报中称该机构调升本季度两类存储产品的合约价格涨幅。具体而言,TrendForce原先预估2024年二季度DRAM内存合约价上涨3~8%,现估计为13~18%;而在NAND闪存方面,原预估上涨13~18%,新预估为15~20%,仅eMMC/UFS涨幅较低,为10%。▲图源TrendForce集邦咨询TrendForce表示,该机构原预计在连续

SK 海力士率先展示 UFS 4.1 通用闪存,基于 V9 TLC NAND 颗粒Aug 09, 2024 am 10:42 AM

SK 海力士率先展示 UFS 4.1 通用闪存,基于 V9 TLC NAND 颗粒Aug 09, 2024 am 10:42 AM本站8月9日消息,根据SK海力士当地时间昨日发布的新闻稿,该企业在FMS2024峰会上展示了系列存储新品,其中就包括尚未正式发布规范的USF4.1通用闪存。根据JEDEC固态技术协会官网,目前已公布的最新UFS规范是2022年8月的UFS4.0。UFS4.0指定了每个设备至高46.4Gbps的理论接口速度,预计USF4.1将在传输速率方面进一步提升。▲JEDECUFS规范页面SK海力士此次展示了两款UFS4.1通用闪存,容量分别为512GB和1TB,均基于321层堆叠的V91TbTLCNAND闪

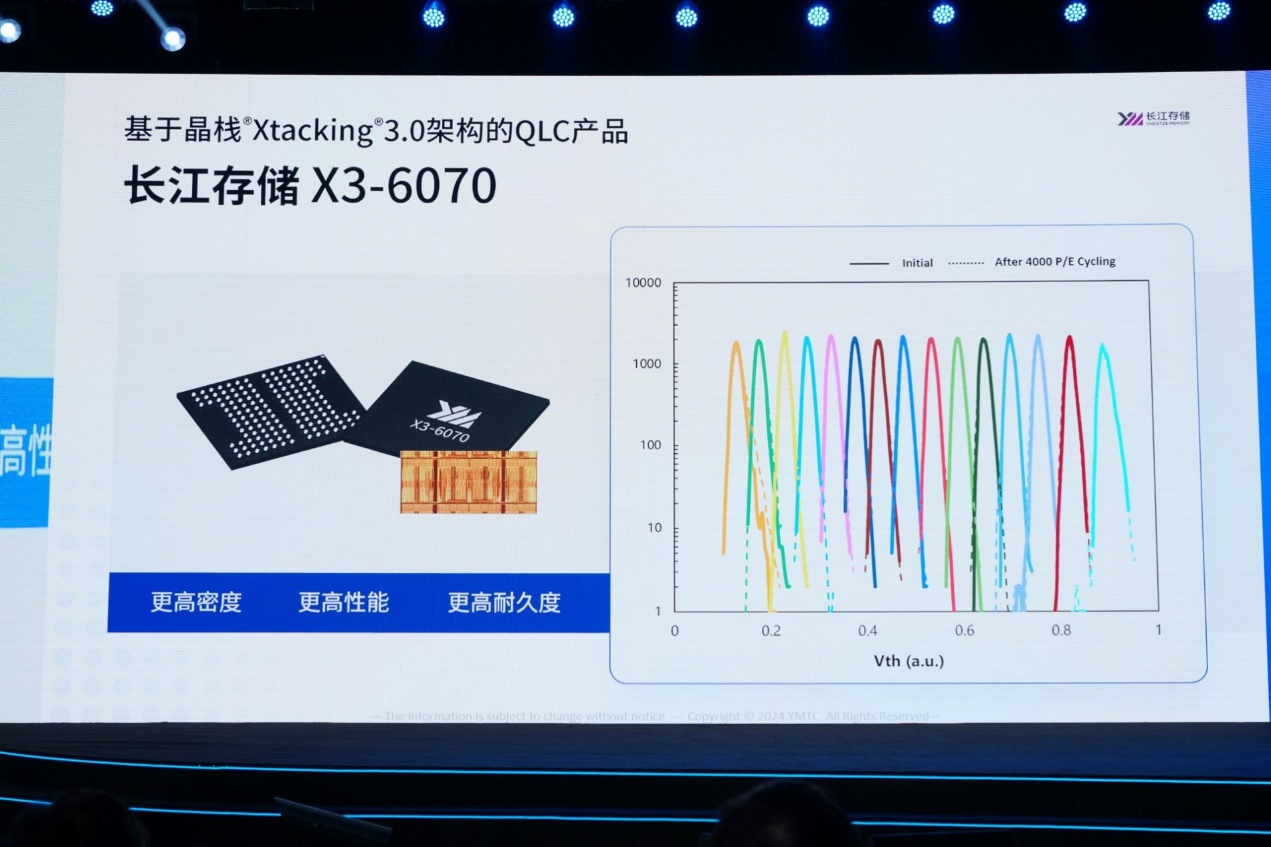

长江存储 QLC 闪存 X3-6070 擦写寿命已达四千次,追上 TLC 产品Mar 28, 2024 pm 03:26 PM

长江存储 QLC 闪存 X3-6070 擦写寿命已达四千次,追上 TLC 产品Mar 28, 2024 pm 03:26 PM本站3月28日消息,据台媒DIGITIMES报道,长江存储在中国闪存市场峰会CFMS2024上表示采用第三代Xtacking技术的X3-6070QLC闪存已实现4000次P/E的擦写寿命。本站注:不同于质保寿命,消费级原厂TLC固态硬盘在测试中普遍至少拥有3000次P/E级别的擦写寿命。▲图源中国闪存市场峰会CFMS官方,下同长江存储CTO霍宗亮表示,目前NAND闪存行业已度过了最艰难的2023年,今年将进入上升期,预计2023~2027年的闪存需求总量复合增长率可达21%,单台设备平均容量的复

苹果 iPhone 将用寿命 / 性能更低的 QLC 闪存Jul 26, 2024 am 01:52 AM

苹果 iPhone 将用寿命 / 性能更低的 QLC 闪存Jul 26, 2024 am 01:52 AM根据国外媒体的报道,苹果将会在2026年发布的新iPhone手机上启用更大的存储设计,预计会是2TB。另外,消息称苹果将会使用QLCNAND闪存,原因可能是控制成本。1.存储容量的变化消息称,苹果可能在iPhone16上改变存储容量。不再使用三层单元(TLC)NAND闪存,而是在存储容量达到或超过1TB的机型上使用四层单元(QLC)NAND闪存。2.QLC闪存的优势与TLC相比,QLC的优势在于每个存储单元可以存储四位数据。在使用相同数量的单元时,比TLC储存更多的数据,或者使用更少的单元储存更

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 Linux new version

SublimeText3 Linux latest version

PhpStorm Mac version

The latest (2018.2.1) professional PHP integrated development tool

Atom editor mac version download

The most popular open source editor

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

Zend Studio 13.0.1

Powerful PHP integrated development environment