Analysis of 9 data charts: How is Blast developing?

- WBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOYWBOriginal

- 2024-06-28 02:50:16414browse

Blast came late. It was originally scheduled to release an airdrop at the end of May, but it has only recently officially announced its governance token plan. The total supply is 100 billion, 50% of which will be airdropped to the community, with an initial airdrop of 17 billion. Additionally, 25.5% is allocated to core contributors, 16.5% to investors, and 8% to the Blast Foundation. As part of the transition to a decentralized governance structure, officials stated that the governance of the project’s Twitter, website, and Blast protocol are moving to foundation control.

OP and Arbitrum have attracted attention due to their airdrops, while ZKsync has become a "negative example". Since Blast opened its airdrop application, the community reputation has also been unsatisfactory. According to Bitget quotes, BLAST is currently quoted at $0.0258.

Blast has been in the limelight since the beginning, but now it is deserted. How has it developed along the way? 9 data charts for you to analyze.

The total number of participating users exceeds 1.56 million, and the daily active users have exceeded 150,000

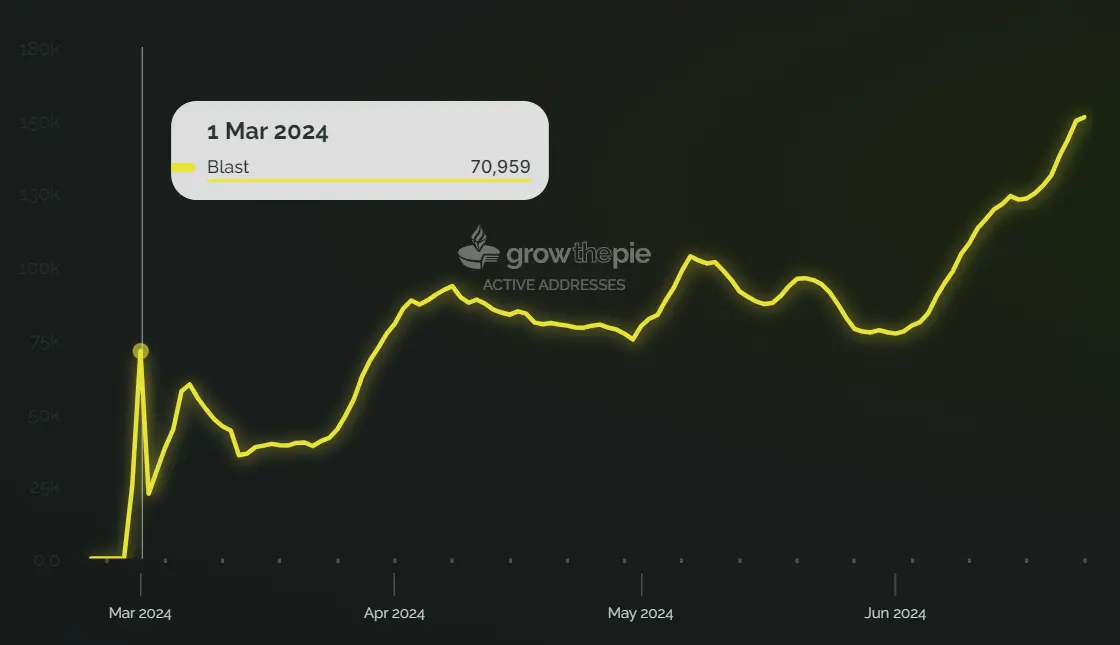

Blast launched the test network in mid-January this year, and officially launched the main network on March 1. According to its official website, the total number of users has reached 1.56 million.

The number of daily active users on the day its mainnet was launched exceeded 70,000, and then declined rapidly. However, it soon continued to rise under the stimulation of various points activities and other incentives. On June 24, its daily active users reached 150,000, doubling the number of daily active users when the mainnet was launched.

Total TVL hit a historical high of US$3.46 billion

Although the Blast testnet was launched in January this year, its opening for staking was on November 21 last year, and it exceeded US$100 million in TVL on the second day, on November 24 It exceeded US$400 million and became the third largest Ethereum L2 with over US$667 million on December 2, second only to Arbitrum and OP. On December 26, its TVL exceeded $1 billion.

It is worth mentioning that TVL exceeded 2 billion on February 25 this year, and Blast became the fastest chain to reach 2 billion US dollars in TVL. It hit a peak of over $3.4 billion in May.

Cross-chain Ethereum exceeds 479,000

According to Dune data, after the launch of the autonomous network, the number of ETH through the cross-chain bridge reached 479,709, accounting for 62.25% of the total cross-chain, and stETH accounted for 479,709. 26.81%, while USDC, USDT and DAI account for 10.94% in total.

The number of active users was the largest when Ethereum was opened for staking and the mainnet was launched

The number of independent users has been more active and increased since the opening of Ethereum for staking at the end of last year and the launch of the mainnet in February 2024.

The cumulative number of new users quickly reached its peak after the mainnet went online.

TOP 10 wallet addresses account for 20.87% of the total funds

In the crypto world, well-known airdrop activities always involve big players. The largest Blast holder ranks first, with a single wallet address accounting for 3.61% of the Blast Holder’s capital volume. The number of tokens of the top 10 Blast holders accounts for 20.87% of the total Blast holders.

USDB has become the fifth most used stablecoin and the fourth most held by users

Blast is a chain with native stablecoins. According to data on June 21, USDB’s 24-hour trading volume reached 115 million US dollars, with 217,000 holders, ranking fifth in terms of activity, and its total market value has exceeded US$400 million.

USDB and WETH are among the top three in terms of yield

In a liquidity pool of more than US$40 million, USDB can achieve a yield of 17.3~32.6% in Blast. WETH can obtain a yield of 7.6~10.5% on Blast.

The number of native DApps accounts for more than 75%

Most EVM chains are full of similar applications, but because Blast provides native yields and Gas fee income sharing, its number of native DApps accounts for more than 75%, far more Far more than the other three major L2s.

The two major products of lending and spot trading have reached a TVL of US$500 million within 4 months

The spot trading protocol Thruster has become the 7th largest DEX protocol, and its TVL exceeded US$500 million within about 80 days of the launch of the mainnet , while another lending product, Juice, also reached US$500 million during the same time and has now become the 9th largest lending protocol.

The above is the detailed content of Analysis of 9 data charts: How is Blast developing?. For more information, please follow other related articles on the PHP Chinese website!