Institutions that applied for issuing ETH ETFs in the US submitted their S-1 applications to the Securities and Exchange Commission (SEC) on June 21.

Institutions applying to launch ether (ETH)-linked exchange-traded funds (ETFs) in the United States submitted their S-1 applications to the Securities and Exchange Commission (SEC) on June 21, bringing many to assume that the highly anticipated ETH ETFs are now days away from launching, possibly even in the first week of July before the U.S. Independence Day celebrations.

The development comes after the SEC finally approved the first round of applications, which were 19b-4 filings submitted by the financial institutions late last month. It then asked them to clarify any questions it had before submitting the S-1 applications, and that is what has transpired.

Now, the SEC will begin reviewing these applications, and once approved, the financial houses behind the applications will be able to start issuing their ETFs, which will finally launch on Wall Street exchanges. Several institutions, including VanEck, Grayscale, BlackRock, Invesco Galaxy Digital, Franklin Templeton, Fidelity, 21 Shares, and more, have sent in their S-1 filings thus far.

Those that have already sent their applications have included details about the management fees for their ETFs — for instance, VanEck states that it will be charging 0.20% from investors. Franklin Templeton’s charges are around the same area at 0.19%. The rest are yet to disclose their fees.

When asked how long it may take to know the fees charged by these ETF providers on X, Bloomberg analyst Eric Balchunas replied, “Prob next week sometime. They can literally wait till nearly last min to add fees.” Regarding BlackRock’s fee, he mentioned, “Adds a touch of pressure on BlackRock to stay under 30bps at least,” talking about the fee structures of competitors VanEck and Franklin Templeton.

Moreover, a seeding of $10 million was disclosed by BlackRock in its filing. Fidelity’s application revealed an investment of $4.3 million offered by FMR Capital at $38 a share. Bitwise’s updated filing from June 19 states that it can receive investments of up to $100 million from Panthera Capital when it launches its ETF.

News source:https://www.kdj.com/cryptocurrencies-news/articles/eth-etfs-applications-submitted-launch-days.html

The above is the detailed content of ETH ETFs Applications Submitted to the SEC, Launch Days Away. For more information, please follow other related articles on the PHP Chinese website!

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AM

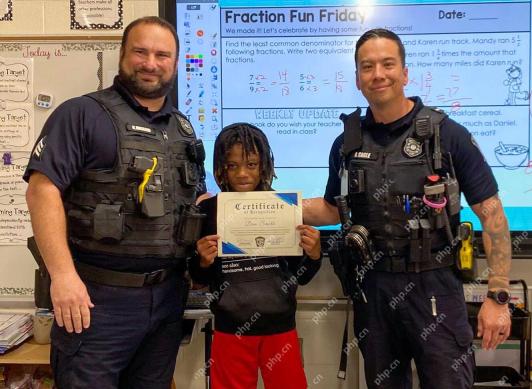

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AMFayetteville Police Department officers Kevin Ingram and David Cagle present Spring Hill Elementary fifth grader Dan Smith with a certificate of recognition for his heroic actions. By FPD

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AM

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AMArtificial Intelligence (AI) has begun to penetrate all aspects of human life, and governance is next. On April 14, the government of the United Arab Emirates (UAE) approved the implementation of what the media is calling the first AI-powered legisla

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AM

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AMOn-chain data reveals that large Shiba Inu investors, referred to as whales, sold their tokens as the coin's value declined.

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AM

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AMSmart crypto investors are looking for an asset with real-world utility and early potential gains in 2025. XRP and Chainlink (LINK) remain the bedrock of solid portfolios but new opportunities

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AM

Ethereum Classic (ETC) Price Prediction: Can It Rise to New Heights as Bitcoin (BTC) and Ethereum (ETH) Make New Highs?Apr 30, 2025 am 11:12 AMAs Bitcoin flirts with the $100,000 milestone and Ethereum climbs closer to the $2,000 mark, the eyes of crypto enthusiasts and investors alike are beginning to focus

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AM

U.S. President Donald Trump's media company is exploring yet another crypto-related ventureApr 30, 2025 am 11:10 AMU.S. President Donald Trump’s media company, called Trump Media & Technology Group, is exploring yet another crypto-related venture, the company said in a letter to shareholders on Tuesday.

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AM

Top 10 digital currency trading apps Recommended by the top 10 digital currency exchange appsApr 30, 2025 am 11:09 AMTop 10 digital currency trading apps: 1. OKX, 2. Binance, 3. Coinbase, 4. Kraken, 5. Huobi, 6. KuCoin, 7. Bitfinex, 8. Gemini, 9. Bitstamp, 10. Poloniex, these platforms are all known for their security, user experience and diverse features, suitable for users with different needs to conduct digital currency transactions.

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AM

Pi Network (PI) Price Prediction: Expert Predicts Spike to $5: Here's the TimelineApr 30, 2025 am 11:08 AMA video by DA CONTENT TV on YouTube dives deep into a bold new prediction for Pi Network (PI). According to the discussion, there is growing optimism that the Pi price could surge dramatically, potentially hitting $5 much sooner than many expected.

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

SublimeText3 Linux new version

SublimeText3 Linux latest version

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

Safe Exam Browser

Safe Exam Browser is a secure browser environment for taking online exams securely. This software turns any computer into a secure workstation. It controls access to any utility and prevents students from using unauthorized resources.

SAP NetWeaver Server Adapter for Eclipse

Integrate Eclipse with SAP NetWeaver application server.

Zend Studio 13.0.1

Powerful PHP integrated development environment