Sorting out the liquidation incident of Curve founder: Why was he indifferent in the third round of DeFi defense battle?

- 王林Original

- 2024-06-20 22:20:101238browse

Written by: Chain Tea House

Curve Finance is a DeFi platform focusing on stablecoin exchange. Its founder Michael Egorov has long used the platform’s governance token CRV as collateral to lend a large number of stablecoins from multiple DeFi platforms. However, CRV The violent fluctuations in token prices put Egorov's lending positions at risk of liquidation.

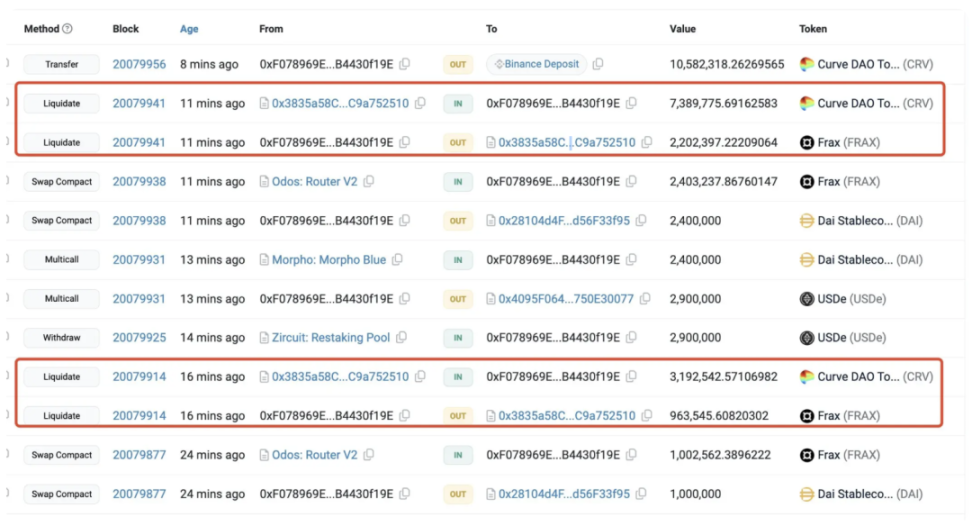

On the evening of June 13, Arkham issued a statement stating that Curve founder Michael Egorov’s nearly 9-digit lending position (CRV of $141 million) had been completely liquidated, and a total of more than $1 million had been generated on Curve’s lending platform Llamalend. of bad debts.

Specifically, Egorov used a large amount of CRV tokens (approximately $141 million) as collateral to lend stablecoins from multiple DeFi platforms, mainly crvUSD. Egorov lends on multiple platforms such as LlamaLend, Inverse, Uwu Lend and Fraxlend, which offer annual interest rates as high as 120%.

Since the storm broke, the CRV price plummeted by nearly 25% in a short period of time, from US$0.35 to US$0.21, triggering the liquidation mechanism of multiple platforms.

This is not the first time that Michael Egorov has been liquidated. In November 2022, there were big shorts in the market trying to short CRV. This was called the first DeFi defense. In order to combat this short-selling behavior, Curve founder Michael Egorov adopted some short-selling strategies in an attempt to stabilize CRV prices. Through these strategies, the price of CRV not only did not fall, but also rebounded. Egorov achieved a stage victory in the confrontation with the short sellers.

The second time was in August last year. Michael Egorov mortgaged a total of 292 million CRV, worth US$181 million, on lending platforms such as Aave, FRAXlend, Abracadabr, and Inverse, and lent US$110 million in funds. Its comprehensive liquidation price Around $0.4.

In last year’s liquidation, in order to avoid liquidation caused by the drop in CRV prices, Michael Egorov took the initiative to cover his position and sold 159.4 million CRV in OTC transactions to 33 investors or institutions in exchange for 63.76 million stablecoins to repay the loan. , save your position.

In addition, in the second round of DeFi defense, Egorov also received support from many well-known investors and institutions, including Wu Jihan, Du Jun, Sun Yuchen, etc. They purchased a large amount of CRV through OTC transactions to help stabilize the market.

But in response to this year’s liquidation crisis, although Curve founder Michael Egorov posted a response on social media that day, the Curve team and I have been working hard to resolve the liquidation risk issue today, but as the public knows, all his loan positions have been liquidated. liquidation.

Based on this predicament, in the third round of DeFi defense battle, Michael Egorov showed indifference, basically not covering positions or saving.

Why can Michael Egorov be so calm? Because he himself "profited" from it.

Regarding the liquidation of CRV positions, Ethereum core developer eric.eth stated that the founder of Curve did not suffer "losses" due to the liquidation of CRV. He received US$100 million from a CRV position worth US$140 million. income.

Michael Egorov’s profit principle is similar to traditional stock borrowing operations. By using Curve DAO tokens (CRV) as collateral, he borrowed a large number of loans on multiple DeFi platforms, except here, the collateral is cryptocurrency. It's not just stocks.

Traditional stock borrowing usually refers to individuals or institutions pledging their stock holdings to financial institutions to obtain loans. This operation can help holders obtain liquidity without selling their shares while continuing to enjoy the stock's appreciation potential.

While Egorov didn’t directly sell his CRV tokens, by borrowing against them as collateral, he essentially converted some of the token’s value into available liquidity. This operation can be seen as a variant of cashing out, as he obtains cash flow by staking the tokens instead of selling the tokens directly.

Of course, after watching Michael Egorov’s calmness in the past few days, it is basically certain that he has given up on Curve and wants to make one last profit before giving up. Compared with the forced discount method of being acquired, mortgaging CRV is indeed more profitable for him.

But on the other side, investors are facing disaster.

The price drop triggered liquidations on other lending platforms. Fraxlend’s lenders suffered millions of dollars in liquidations. According to Lookonchain monitoring, 10.58 million CRV ($3.3 million) were liquidated by users on Fraxlend.

Also facing huge losses are early CRV investors and other investors in its ecosystem. According to DeFiLlama data, as of June 18, Curve’s tvl has dropped to US$1.9 billion, compared with the high of US$23 billion in 2022 , TVL has shrunk to less than one-tenth of its original size, and its ranking in the DeFi market has dropped to outside 15th place.

Of course, in the face of this liquidation storm, there are also people who support and profit from it. For example, Christian, co-founder of crypto fund NDV and NFT whale, said that he received 30 million CRV from Michael Egorov to support the future of Curve and DeFi. It is reported that Christian bought CRV off-site for about US$6 million, that is, the price of each CRV token is US$0.2. According to today’s current price of US$0.28, the floating profit on the book is about 40%.

No matter what the follow-up direction of this matter is, judging from the current attitude of founder Michael Egorov, Curve has no way out. This two popular DeFi products that were once on par with Uniswap were disrupted by the founder himself, which has to be lamented. Of course, judging from these several DeFi defense battles, the development of the DeFi track currently has many shortcomings, and I hope that project parties will learn from it.

The above is the detailed content of Sorting out the liquidation incident of Curve founder: Why was he indifferent in the third round of DeFi defense battle?. For more information, please follow other related articles on the PHP Chinese website!