web3.0

web3.0 After the Ethereum spot ETF passes, will SOL be the next ETF? Will Grayscale transform into spot ETFs?

After the Ethereum spot ETF passes, will SOL be the next ETF? Will Grayscale transform into spot ETFs?

As the U.S. Securities and Exchange Commission (SEC) officially approved the 19b- 4 document (change of exchange rules), the community also began to discuss which cryptocurrency will be the next lucky one to launch an ETF?

Prove that Ethereum is not a security?

Previously, the market was worried that the SEC would reject the application on the grounds that ETH is a security. However, the current approval is equivalent to acquiescing to the attitude that Ethereum is not a security. However, in the future, the SEC may also conduct regulatory discussions on the issue of Ethereum staking. After all, the above-mentioned issuers urgently deleted their plans to pledge ETH in the future this week.

But overall, the approval of the Ethereum spot ETF may give the green light for other cryptocurrencies to become the next ETF.

Will SOL be the next ETF?

Currently the most discussed one on the market is Solana, which was once known as the killer of Ethereum. Some analysts have previously predicted that once the Ethereum spot ETF is approved, SOL will be a strong competitor for the next virtual asset ETF. Bernstein once pointed out in a research report: If the United States approves the Ethereum spot ETF, this will be regarded as a major regulatory change for the encryption industry, and it will also increase the expectation that ETH competitor SOL will be classified as a commodity. Tactically, the launch of an Ethereum spot ETF would be the first precedent for a non-Bitcoin asset to be treated as a commodity, raising hopes that SOL will follow the same path.

In addition, Matrixport co-founder Daniel Yan also said earlier: If the Ethereum ETF is approved, SOL will be next. The better trade at the moment is to buy the SOL/ETH trading pair, although this may seem ridiculous. Compared to Ethereum, SOL may have better trading prospects and profit potential.

Will Grayscale’s cryptocurrency funds be transformed into spot ETFs?

Another reference that can be provided is that we know that Grayscale has successfully transformed GBTC and ETHE into spot ETFs, so it is not ruled out that they will do the same with other cryptocurrency funds under their umbrella.

Currently, the giant also manages at least the following cryptocurrency funds:

- Grayscale Ethereum Classic Trust (ETCG)

- Grayscale Litecoin Trust ( LTCN)

- Grayscale Bitcoin Cash Trust (BCHG)

- Grayscale Zcash Trust (ZCSH)

- Grayscale Stellar Lumens Trust (GXLM)

- Grayscale HorizenTrust (HZEN)

- Grayscale DecentralandTrust(MANA)

- Grayscale ChainlinkTrust(LINK)

- Grayscale Filecoin Trust (FIL)

- Grayscale Basic Attention Token Trust (BAT)

- The U.S. House of Representatives passed the "FIT21 Cryptocurrency Bill"

Another good news is that the U.S. House of Representatives also passed the "FIT21 Cryptocurrency Bill" yesterday (23rd) The vote of 279 to 136 approved a bill that is expected to reshape the US encryption regulatory landscape-the "21st Century Financial Innovation and Technology Act."

Next, the Senate will vote at the end of the month, and US President Biden also stated that if the bill is passed by Congress, he will not veto it, and even called on Congress to provide a comprehensive and balanced approach to digital assets. Cooperation on Regulatory Framework: The Administration is eager to work with Congress to ensure a comprehensive and balanced regulatory framework for digital assets.

It is understood that the core of the FIT21 bill is to clearly discuss the positioning of cryptocurrency as a "digital commodity" and stipulate the regulatory scope of the U.S. Commodity Futures Trading Commission (CFTC) and the U.S. Securities and Exchange Commission (SEC). The proposed bill stipulates that the CFTC will treat cryptocurrency with functional and decentralized characteristics as a commodity for supervision, while cryptocurrency that is functional but does not meet the conditions for decentralization will be treated as a security and handed over to the CFTC. SEC regulation.

Although the details of the bill have yet to be discussed, once it is passed, companies and investors in the Web3 field will be able to better understand their respective legal rights and obligations, reduce regulatory uncertainty, and promote industry innovation. and development.

The above is the detailed content of After the Ethereum spot ETF passes, will SOL be the next ETF? Will Grayscale transform into spot ETFs?. For more information, please follow other related articles on the PHP Chinese website!

比特币ETF可以买吗?如何购买?Feb 01, 2024 am 08:15 AM

比特币ETF可以买吗?如何购买?Feb 01, 2024 am 08:15 AM1、比特币ETF可以买吗?如何购买?比特币ETF可以买吗?如何购买?随着比特币的不断升值,越来越多的投资者开始关注比特币ETF(ExchangeTradedFund)。那么,比特币ETF可以买吗?如何购买呢?ETF是交易所交易基金,是一种低成本、高流动性的投资工具。它让投资者能以相对低的成本投资于一系列资产,如股票、债券、商品等。ETF的价格会随所持有资产的价格波动而变化。它具有市场交易性和实时估值的特点,投资者可以通过买卖ETF来获取资产的收益。ETF的市场规模越来越大,已成为许多投资者多元化

下一个炒作ETF的会是什么币 为什么63.6%的人选择SOLJun 11, 2024 pm 05:02 PM

下一个炒作ETF的会是什么币 为什么63.6%的人选择SOLJun 11, 2024 pm 05:02 PM下一个炒作ETF的会是什么代币?为什么那么多人选择SOL?SOL上周五发起了一个投票“在$BTC$ETH之后,你觉得下一个炒作ETF的会是什么代币?”结果63.6%的人选择了SOL。今天本站小编给大家分享的是下一个炒作ETF的会是什么代币?为什么那么多人选择SOL呢?下面一起看看吧!ETHETF通过之后,市场确实对SOL的呼声很高渣打银行外汇和数字资产研究主管GeoffreyKendrick:2025年或将迎来SOL、XRP等加密货币ETF的批准。天桥资本创始人兼管理合伙人Anth

一文了解贝莱德1500亿美元模型投资组合添加比特币现货ETFMar 04, 2025 am 10:51 AM

一文了解贝莱德1500亿美元模型投资组合添加比特币现货ETFMar 04, 2025 am 10:51 AM据彭博社报道,全球资产管理巨头贝莱德在其规模达1500亿美元的模型投资组合中,将允许配置其比特币现货ETF“IBIT”。该投资组合可将1%到2%的资金用于贝莱德价值480亿美元的IBIT。虽然这仅占贝莱德模型投资组合业务的一小部分,但此举在当前市场情绪低迷的情况下,为IBIT带来了潜在的新资金来源。贝莱德的模型投资组合为财务顾问提供多种现成投资策略,近年来发展迅速,其投资组合调整往往会带来显著的资金流动。贝莱德目标配置ETF模型投资组合首席投资组合经理MichaelGates表示:“我们看好比

SOL的ETF有没有申请?一文了解SOLANA ETF的申请进程Mar 03, 2025 pm 09:00 PM

SOL的ETF有没有申请?一文了解SOLANA ETF的申请进程Mar 03, 2025 pm 09:00 PMSolana(SOL)ETF申请:深度解析及未来展望近期,加密ETF申请热潮涌动,这与SEC对加密货币日渐友好的态度以及明确的审批规则密切相关。作为主流加密货币,Solana(SOL)的ETF申请进展备受关注。本文将深入探讨SOLETF申请的现状、影响及未来展望。SOLETF申请现状多家机构已提交SOL现货ETF申请,其中Grayscale尤为引人注目,其计划将Solana信托基金转换为现货ETF,这将使其在数字资产市场的影响力进一步扩大。若获批,该ETF将在纽约证券交易所上市,代码为

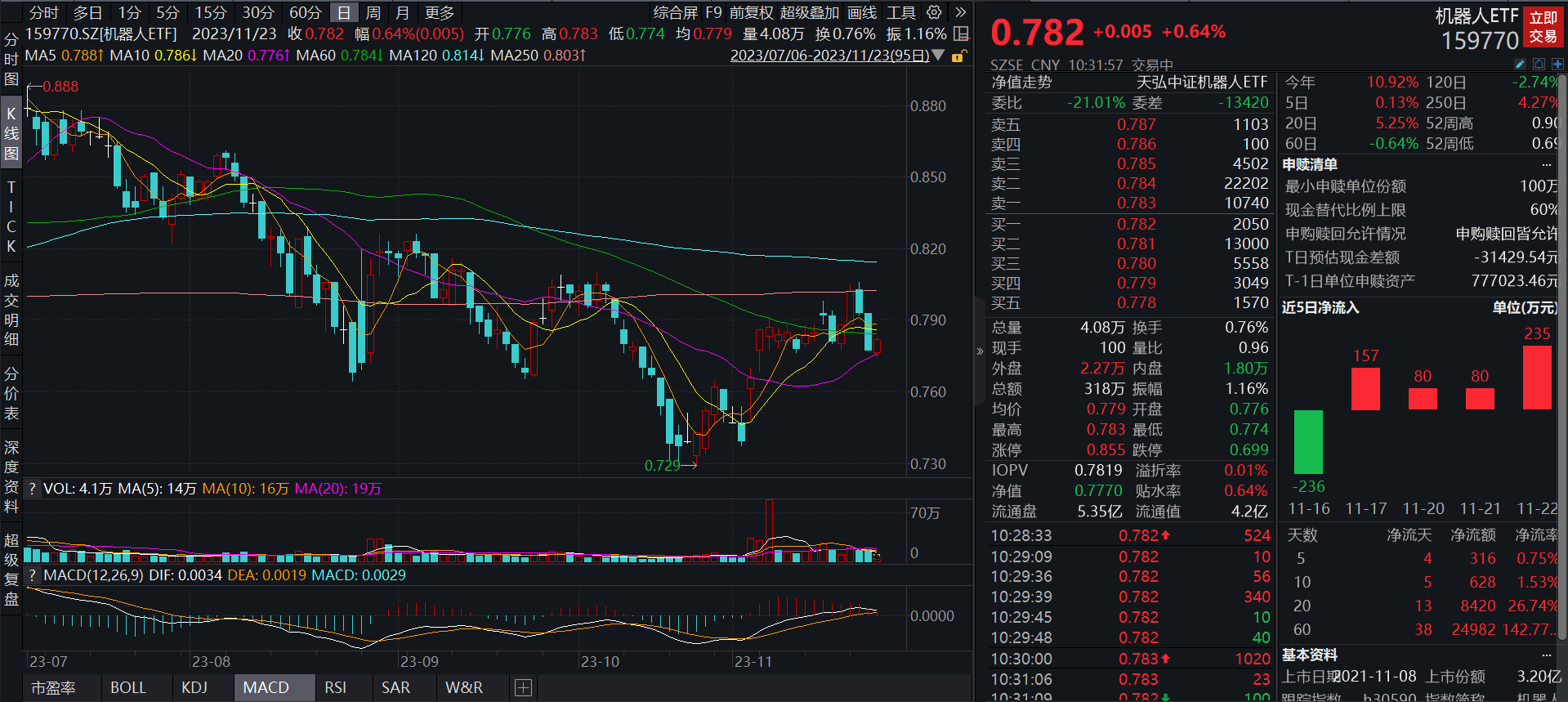

机器人ETF(159770):连续4天吸引资金净流入,《人形机器人创新发展指导意见》可能推动产业发展进程Nov 23, 2023 pm 02:33 PM

机器人ETF(159770):连续4天吸引资金净流入,《人形机器人创新发展指导意见》可能推动产业发展进程Nov 23, 2023 pm 02:33 PM截至2023年11月23日10:31,机器人ETF(159770)早盘震荡翻红,已涨0.64%,报0.782元。数据显示,该基金已连续4日获资金净流入,备受市场关注。来源数据:Wind,2023年11月23日机器人ETF(159770)紧密跟踪中证机器人指数,截至2023年11月23日10:31,指数成份股中,大恒科技领涨6.07%,赛腾股份上涨5.14%,瑞鹄模具上涨3.71%,鸣志电器、秦川机床等个股跟涨超2%。来源数据:Wind,2023年11月23日该指数从沪深市场中选取系统方案商、数字

贝莱德计划推出欧洲比特币ETP、预计将在瑞士注册!IBIT资金规模来到580亿美元Mar 05, 2025 am 10:33 AM

贝莱德计划推出欧洲比特币ETP、预计将在瑞士注册!IBIT资金规模来到580亿美元Mar 05, 2025 am 10:33 AM全球资产管理巨头贝莱德(BlackRock)计划在欧洲推出其首个比特币交易所交易产品(ETP),预计将在瑞士注册。贝莱德比特币ETP:瑞士注册,即将面世据彭博社报道,知情人士透露,贝莱德计划在瑞士发行这款比特币ETP,最快可能本月启动推广。贝莱德发言人对此未予评论。作为全球最大的ETF发行商,贝莱德管理着超过4.4万亿美元的ETF资产。此举标志着贝莱德首次进军北美以外的加密货币ETP市场。贝莱德IBIT规模达580亿美元,加密市场持续火热贝莱德已成为华尔街最积极拥抱数字资产的金融机构之一。其首席

Bitcoin ETF Token价格预测2024-2030Mar 21, 2024 pm 03:08 PM

Bitcoin ETF Token价格预测2024-2030Mar 21, 2024 pm 03:08 PM2024年底:2024 年,比特币 ETF 可能会开始交易,并推出多个新的比特币 ETF。这可能会引发一个对$BTCETF加倍有利的加密牛市。我们预计年底价格为 0.30 美元。2025年底:随着比特币价格达到 100,000 美元,比特币 ETF 代币可能会再次经历一次代币销毁。我们预计$BTCETF的价格将上涨至 0.40 美元。

比特币etf有哪些Mar 19, 2025 pm 05:06 PM

比特币etf有哪些Mar 19, 2025 pm 05:06 PM本文介绍了常见的比特币ETF,包括iShares Bitcoin Trust(IBIT)、Grayscale Bitcoin Trust(GBTC)、Fidelity Wise Origin Bitcoin Fund(FBTC)、Ark 21Shares Bitcoin ETF(ARKB)、Bitwise Bitcoin ETF Trust(BITB)、Grayscale Bitcoin Mini Trust(BTC)、ProShares Bitcoin ETF(BITO)、WisdomTree

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

SublimeText3 Mac version

God-level code editing software (SublimeText3)

SublimeText3 Linux new version

SublimeText3 Linux latest version

SecLists

SecLists is the ultimate security tester's companion. It is a collection of various types of lists that are frequently used during security assessments, all in one place. SecLists helps make security testing more efficient and productive by conveniently providing all the lists a security tester might need. List types include usernames, passwords, URLs, fuzzing payloads, sensitive data patterns, web shells, and more. The tester can simply pull this repository onto a new test machine and he will have access to every type of list he needs.

WebStorm Mac version

Useful JavaScript development tools

SublimeText3 English version

Recommended: Win version, supports code prompts!