From the Bitcoin ETF at the beginning of the year to the current Ethereum ETF, BlackRock has earned a lot of attention. It also reflects the impact of institutions on the market trend of the currency circle. Many novices may not know about BlackRock. What kind of company is De? BlackRock is one of the world's leading asset management companies, headquartered in New York City, USA. It was founded in 1988 by Larry Fink and Robert Kaplan. BlackRock is world-famous for its vast asset management business and investment management services and is one of the world's largest asset management companies. The editor below will introduce BlackRock to you in detail.

What kind of company is BlackRock?

BlackRock Investment Management is an investment management company that provides a range of investment management and technology services to institutional and retail clients. Founded in the late 1980s, BlackRock quickly gained a reputation in the financial industry, known for its meteoric rise and pioneering advances in risk assessment, a digital investment approach that helps asset holders strengthen their investments. Fight the vagaries of the market. It began its journey as a spin-off of Blackstone Group (particularly the private equity firm) and soon embarked on an independent path after quickly building profitability in the early stages.

Initially BlackRock's expertise was in risk management, structuring the issuance of fixed income securities (including government and corporate bonds) and mortgage-backed products. Soon after, BlackRock broadened its horizons and became involved in a broader range of investment strategies. This expansion has led to the creation of actively managed and passive (index) mutual funds, as well as ETFs sold under the "iShares" label (similar to mutual funds but traded like stocks), as well as operators of sophisticated fund risk management tools.

BlackRock's current position as the premier asset management entity is undisputed, with its products including single and multi-asset portfolios investing in equities, fixed income, alternatives and money market instruments.

Its products are offered directly or through intermediaries through a range of vehicles, including open- and closed-end mutual funds, iShares exchange-traded funds, separate accounts, collective investment funds and other collective investment vehicles. The company also provides technology services, including investment and risk management technology platforms, Aladdin, AladdinWealth, eFront and Cachematrix, as well as advisory services and solutions.

Who is the boss of BlackRock?

The boss of BlackRock Group is Larry Fink. Larry Fink is the founder and CEO of BlackRock and is known as the "Godfather of Wall Street." Mr. Fink co-founded BlackRock with seven partners in 1988 and led it to become the world's leading asset management company, providing risk management and advisory services to institutional and retail clients. Mr. Fink was selected as one of the "World's Most Respected Leaders" by Forbes magazine in 2016, "Best CEO of the Past Decade" by Financial News in 2011 and "Barron's" for 12 consecutive years. Magazine selected him as one of the "World's Best CEOs".

Before founding BlackRock in 1988, Mr. Fink was the managing director and member of the management committee of The First Boston Corporation. While at First Boston, he also served as co-head of the taxable fixed income group, which was responsible for the trading and issuance of all government bonds, mortgage-backed securities and corporate securities.

Mr. Fink currently serves as a trustee of the New York University Trust Board of Trustees and as co-chairman of the New York University Gurney Medical Center Trust Board. Mr. Fink serves on the boards of the Museum of Modern Art (MoMA), the Council on Foreign Relations, and the Nature Conservancy. He also serves on the Executive Committee of The Partnership for New York City.

The above is the detailed content of What kind of company is BlackRock? Who is the boss of BlackRock?. For more information, please follow other related articles on the PHP Chinese website!

贝莱德是什么公司?贝莱德公司老板是谁?Jun 03, 2024 pm 07:48 PM

贝莱德是什么公司?贝莱德公司老板是谁?Jun 03, 2024 pm 07:48 PM从年初比特币ETF到当前的以太坊ETF,贝莱德公司可谓是赚足了眼球,同时也体现出机构对于币圈在行情趋势上的影响,有很多新手可能还不了解贝莱德是什么公司?贝莱德是全球领先的资产管理公司之一,总部位于美国纽约市,成立于1988年,由拉里·芬克和罗伯特·卡普兰共同创立。贝莱德以其庞大的资产管理业务和投资管理服务而闻名于世,是全球最大的资产管理公司之一。下面小编为大家详细介绍一下贝莱德公司。贝莱德是什么公司?贝莱德投资管理公司是一家投资管理公司,该公司为机构和零售客户提供一系列投资管理

贝莱德在巴西推出比特币现货ETF,ETF市场占比特币总供应量的4%Mar 02, 2024 pm 06:31 PM

贝莱德在巴西推出比特币现货ETF,ETF市场占比特币总供应量的4%Mar 02, 2024 pm 06:31 PM贝莱德(BlackRock)是全球最大的资产管理公司之一,宣布将在巴西推出iShares比特币信托ETF(IBIT39)。该基金将于3月1日在巴西商品和期货交易所(B3)上市,旨在追踪比特币(BTC)现货价格指数。这一举措标志着比特币在金融市场中的进一步认可和接受,为巴西投资者提供了更多多样化投资的机会。BlackRock在巴西推出IBIT39比特币ETFBlackRock巴西区总裁KarinaSaade强调了公司致力于为数字资产市场的投资者提供高质量接入工具的承诺。她表示:"IBIT39是我们

一文了解贝莱德1500亿美元模型投资组合添加比特币现货ETFMar 04, 2025 am 10:51 AM

一文了解贝莱德1500亿美元模型投资组合添加比特币现货ETFMar 04, 2025 am 10:51 AM据彭博社报道,全球资产管理巨头贝莱德在其规模达1500亿美元的模型投资组合中,将允许配置其比特币现货ETF“IBIT”。该投资组合可将1%到2%的资金用于贝莱德价值480亿美元的IBIT。虽然这仅占贝莱德模型投资组合业务的一小部分,但此举在当前市场情绪低迷的情况下,为IBIT带来了潜在的新资金来源。贝莱德的模型投资组合为财务顾问提供多种现成投资策略,近年来发展迅速,其投资组合调整往往会带来显著的资金流动。贝莱德目标配置ETF模型投资组合首席投资组合经理MichaelGates表示:“我们看好比

贝莱德私享会观点摘要:投资组合有 3 成 BTC 仓位并非不合理,牛市将会有意料之外的参与者Mar 01, 2024 am 11:10 AM

贝莱德私享会观点摘要:投资组合有 3 成 BTC 仓位并非不合理,牛市将会有意料之外的参与者Mar 01, 2024 am 11:10 AM撰文:TheOldTaylor编译:深潮TechFlow最近,贝莱德为他们的顶级客户和行业参与者举办了一次私人活动,活动中传递了一些令人振奋的消息。我从这次活动中得到的启示主要包括以下四个要点。要点1贝莱德举办了一场专门活动,旨在向其优质客户推广比特币ETF。这表明贝莱德正在积极准备利用其营销和销售团队来推广比特币及其相关ETF产品。要点2贝莱德的高级职员曾说过:”我们接到了很多人的电话,我们从没想过我们会接到他们的电话"。如果这些电话能让贝莱德感到惊讶,那么对我们来说也是一个惊喜。这也让我们意

SEC文件披露:瑞银集团持有3600股 贝莱德 iShares 比特币信托(IBIT)基金Jun 11, 2024 pm 01:56 PM

SEC文件披露:瑞银集团持有3600股 贝莱德 iShares 比特币信托(IBIT)基金Jun 11, 2024 pm 01:56 PM最近美国证券交易委员会(SEC)的一份文件显示,瑞士银行瑞银集团(UBS)持有贝莱德(BlackRock)的iShares比特币信托(IBIT)的大量股份。在最近提交给SEC的一份13F文件中,总部位于瑞士的全球投资银行和金融服务公司瑞银集团(UBS)披露了其对iShares比特币信托(IBIT)的大量持股,据悉,该信托是由贝莱德(BlackRock)管理的交易所交易基金(ETF)。从瑞银集团在2024年第一季度,提交给SEC的13F文件中显示,瑞银集团通过旗下多个子公司和投资管理机构共持有36

贝莱德会申请 XRP 和 Solana 等山寨币作为下一步的现货 ETF 计划吗?Jul 28, 2024 pm 08:19 PM

贝莱德会申请 XRP 和 Solana 等山寨币作为下一步的现货 ETF 计划吗?Jul 28, 2024 pm 08:19 PM随着比特币和以太坊的现货ETF正式进入交易市场,市场开始热议资产管理巨头贝莱德是否会将目光投向Solana和XRP等其他加密货币,以探索推出更多现货ETF的可能性。这一猜测不仅牵动着投资者的神经,也可能预示着加密货币市场的新动向。考虑到贝莱德在全球金融领域的重要地位,他们的任何决策都可能引发连锁反应,影响整个加密货币市场的动态。因此,贝莱德是否会为Solana和XRP等山寨币申请现货ETF,成为了一个备受瞩目的话题。贝莱德对山寨币ETF的态度尽管比特币和以太坊的现货ETF已经成功上市,但贝莱德似

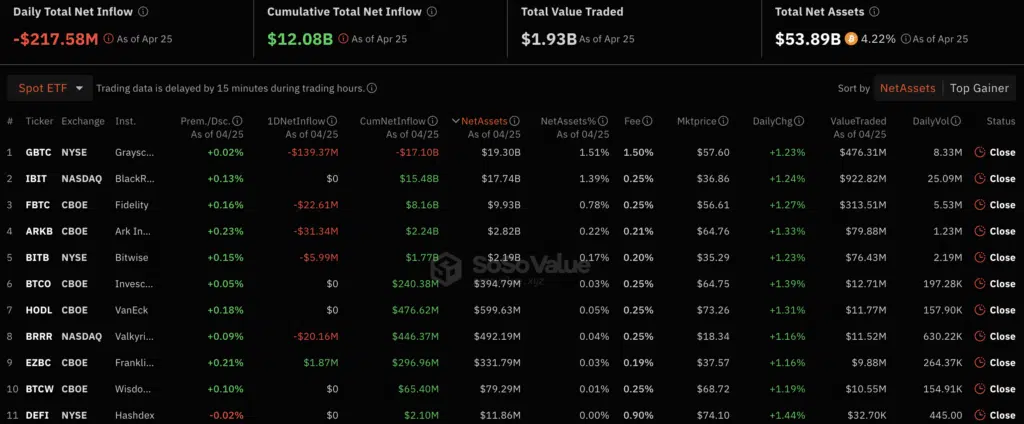

贝莱德的比特币ETF出现2.17亿美元资金流出Apr 27, 2024 pm 09:34 PM

贝莱德的比特币ETF出现2.17亿美元资金流出Apr 27, 2024 pm 09:34 PM现货比特币ETF领域再次陷入亏损区,4月25日经历了2.17亿美元的资金流出。根据SoSoValue的数据显示,包括贝莱德旗下的iShares比特币信托ETF(IBIT)在内的五个ETF在近日均未出现资金流入。需要提到的是,贝莱德的这只基金已经连续第二天没有记录到资本的流入。图片来源:SoSoValue除了灰度比特币信托ETF(GBTC)之外,还有四个ETF记录了资金流出,其中包括来自FidelityInvestment和ARKInvest/21Shares的ETF。尽管最近出现了资金流出的趋势

贝莱德向两只基金增持 410 万美元 IBIT 现货比特币 ETFJun 05, 2024 pm 01:36 PM

贝莱德向两只基金增持 410 万美元 IBIT 现货比特币 ETFJun 05, 2024 pm 01:36 PM贝莱德,全球领先的资产管理公司,在2024年第一季度对其两只基金:贝莱德战略收入机会投资组合(BSIIX)和贝莱德战略全球债券基金(MAWIX)进行了增持,分别向它们增加了价值360万美元和486,000美元的iShares比特币信托(IBIT)股票,总价值达410万美元。这一增持行为体现了贝莱德对比特币(BTC)投资的积极态度。根据5月28日提交给美国证券交易委员会(SEC)的文件,贝莱德此前在3月8日的文件中已经披露了将IBIT添加到其其他基金的计划。此外,贝莱德还在5月10日的13F文件中

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

AI Hentai Generator

Generate AI Hentai for free.

Hot Article

Hot Tools

MinGW - Minimalist GNU for Windows

This project is in the process of being migrated to osdn.net/projects/mingw, you can continue to follow us there. MinGW: A native Windows port of the GNU Compiler Collection (GCC), freely distributable import libraries and header files for building native Windows applications; includes extensions to the MSVC runtime to support C99 functionality. All MinGW software can run on 64-bit Windows platforms.

DVWA

Damn Vulnerable Web App (DVWA) is a PHP/MySQL web application that is very vulnerable. Its main goals are to be an aid for security professionals to test their skills and tools in a legal environment, to help web developers better understand the process of securing web applications, and to help teachers/students teach/learn in a classroom environment Web application security. The goal of DVWA is to practice some of the most common web vulnerabilities through a simple and straightforward interface, with varying degrees of difficulty. Please note that this software

Notepad++7.3.1

Easy-to-use and free code editor

SublimeText3 Mac version

God-level code editing software (SublimeText3)

Atom editor mac version download

The most popular open source editor