Source: distilledcrypto has arrived. But when should I sell my crypto? You might rely on your gut to tell when the bull market peaks, but is there a better way? Please remember: "Failing to prepare means preparing to fail."

The Pitfalls of Price Forecasting It is a common mistake to rely solely on price targets to manage your investments. Such goals are often subjective and easily driven by emotions or influenced by social media. It is extremely difficult to accurately predict prices and predict the timing of price changes.

It is a common mistake to rely solely on price targets to manage your investments. Such goals are often subjective and easily driven by emotions or influenced by social media. It is extremely difficult to accurately predict prices and predict the timing of price changes.

In addition to price prediction, are there any reliable strategies? We have many options: sentiment, technical indicators or on-chain analysis. However, strategies centered around investment ideas often prove to be the most reliable.

In addition to price prediction, are there any reliable strategies? We have many options: sentiment, technical indicators or on-chain analysis. However, strategies centered around investment ideas often prove to be the most reliable.

An investment philosophy is a rational argument for a project’s potential within a specified time frame. The factors that shape this argument are diverse and not always related to price. Good ideas should be testable, allowing for precise and flexible management.

Why concept investment is more reliableThe reason why concept investment is reliable is for the following reasons:

As you continue to grow Portfolio ExpansionEliminate the Impact of Sentiment and Emotion- Provide Clear Verification Methods

- Eliminate Short-Term Noise

- Example 1

- Suppose you are very optimistic about the prospects of a certain L1. Instead of looking at its past ATH (all-time high price), you can look at:

TVL, trading volume, or the number of active wallets. Going a step further, you can look at related metrics like its market share or mind share.

Next, set up validation based on the key performance indicators (KPIs) of your choice. This helps to check if L1 is following the path you predicted or deviating. For example, you could use 30 days of growth in a KPI as a benchmark.

Example 2

Imagine a new project for an artificial intelligence agent. Instead of price, you can focus on KPIs like number of agent transactions. Based on your beliefs, you set a benchmark, such as reaching 1 million on-chain transactions.

Are you interested in lesser-known and more volatile tokens?

Many companies have only a minimum viable product (MVP) or no active product at all. In this case, focus on roadmap nodes or milestones.

Also, if your investment philosophy focuses on event execution rather than metric growth. As they say, "Buy rumors, sell news." Sometimes it's wiser to quit immediately after confirming the date than to wait for the event to happen. Later, you can set new metrics and develop new ideas.

Other strategies

If you feel that complex concept strategies are not suitable for you? You can consider the following alternatives:

Time-Based StrategyFear and Greed Strategy- Relative Performance

- Time-based strategies

Time-based strategies provide a simpler and more reliable approach. You can sell a small portion of your portfolio every week or every month. Adjust the timing and amount of sales based on macro factors, liquidity, and your goals.

Fear and Greed Strategy

Fluctuations in market sentiment are like the tides of the ocean, exacerbating greed. The fear and greed strategy is to ride the rising tide and secure gains before the tide recedes. You could consider a weighted DCA-out strategy based on the fear and greed index.

Relative Performance

Imagine the market is a race and each token is like a speeding car. Now, the key point is to determine which car accelerates faster relative to the other cars. One way to realize a profit is to sell when it reaches a certain float market cap ranking.

FINAL THOUGHTS

Cryptocurrencies are highly speculative and emotions often take over. A risk system that operates independently of price can provide peace of mind. Therefore, please prioritize forming your own investment philosophy rather than guessing. This is an essential quality for successful investors.

The above is the detailed content of If a mad cow comes, how can we be safe?. For more information, please follow other related articles on the PHP Chinese website!

Top 10 Reliable Digital Currency Exchange Rankings Summary of the Top 10 Digital Currency Apps in the WorldApr 30, 2025 pm 03:36 PM

Top 10 Reliable Digital Currency Exchange Rankings Summary of the Top 10 Digital Currency Apps in the WorldApr 30, 2025 pm 03:36 PMTop 10 reliable digital currency exchanges rankings: 1. Binance, 2. OKX, 3. Coinbase, 4. Kraken, 5. Huobi Global, 6. Bitfinex, 7. KuCoin, 8. Gemini, 9. Bitstamp, 10. Bittrex, these platforms offer high security and a variety of trading options, suitable for different user needs.

Top 10 Virtual Digital Currency Exchange App Rankings Top 10 Virtual Currency Trading Platforms in the WorldApr 30, 2025 pm 03:33 PM

Top 10 Virtual Digital Currency Exchange App Rankings Top 10 Virtual Currency Trading Platforms in the WorldApr 30, 2025 pm 03:33 PMTop 10 virtual digital currency exchange app rankings: 1. Binance, 2. OKX, 3. Coinbase, 4. Kraken, 5. Huobi, 6. KuCoin, 7. Bitfinex, 8. Bittrex, 9. Gemini, 10. Bitstamp, these platforms have their own characteristics, covering the advantages of efficient trading systems, rich trading pairs, multi-level security measures, relatively low transaction fees, and innovative products, to meet the needs of different users.

SEC recently announced delays in its decision to Dogecoin and XRP ETFs, which could reshape Altcoin's landscapeApr 30, 2025 pm 03:30 PM

SEC recently announced delays in its decision to Dogecoin and XRP ETFs, which could reshape Altcoin's landscapeApr 30, 2025 pm 03:30 PMAfter the approval of the Bitcoin ETF last year, crypto asset managers have turned their attention to Altcoin ETF, increasing the possibility of investment choices. According to the regulator's latest timetable, the Securities and Exchange Commission (SEC) will make a decision on the proposed DogecoinETF for Bitwise and Franklin Templeton's XRP products in mid-June. There are also proposals pending, including applications from Factorial’s Grayscale and Cardano Futures ETFs, as well as Solana and Litecoin ETFs, which highlight diversified pathways to invest in cryptocurrencies beyond Bitcoin. This year, as asset managers approve spot stock

Will Sui Bulls or Bears control after a 63% intense rally once a week?Apr 30, 2025 pm 03:27 PM

Will Sui Bulls or Bears control after a 63% intense rally once a week?Apr 30, 2025 pm 03:27 PMIf there is a coin, because the bull and bear are throwing punches for control, it is sui[sui]. And, can you blame them? If there is a coin with a bull and a bear punch for control, it is sui[sui]. And, can you blame them? 63% of the hot rally once a week just pushed into S

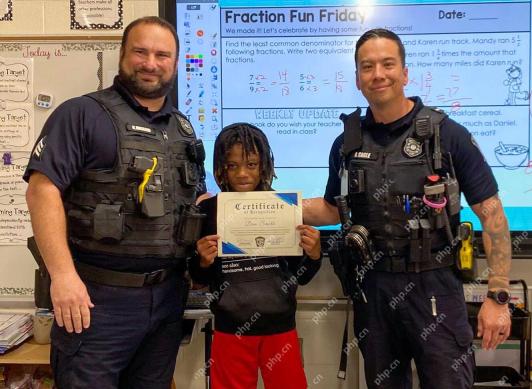

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AM

Quick-thinking Sun Saves LifeApr 30, 2025 am 11:22 AMFayetteville Police Department officers Kevin Ingram and David Cagle present Spring Hill Elementary fifth grader Dan Smith with a certificate of recognition for his heroic actions. By FPD

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AM

UAE Enables AI Interaction in Lawmaking With New Smart Legislative SystemApr 30, 2025 am 11:20 AMArtificial Intelligence (AI) has begun to penetrate all aspects of human life, and governance is next. On April 14, the government of the United Arab Emirates (UAE) approved the implementation of what the media is calling the first AI-powered legisla

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AM

Whales Have Dumped 10 Trillions of SHIB Tokens, Plunging the Price by 60% From Its All-Time HighApr 30, 2025 am 11:18 AMOn-chain data reveals that large Shiba Inu investors, referred to as whales, sold their tokens as the coin's value declined.

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AM

3 Hidden Altcoin Gems to WatchApr 30, 2025 am 11:14 AMSmart crypto investors are looking for an asset with real-world utility and early potential gains in 2025. XRP and Chainlink (LINK) remain the bedrock of solid portfolios but new opportunities

Hot AI Tools

Undresser.AI Undress

AI-powered app for creating realistic nude photos

AI Clothes Remover

Online AI tool for removing clothes from photos.

Undress AI Tool

Undress images for free

Clothoff.io

AI clothes remover

Video Face Swap

Swap faces in any video effortlessly with our completely free AI face swap tool!

Hot Article

Hot Tools

MantisBT

Mantis is an easy-to-deploy web-based defect tracking tool designed to aid in product defect tracking. It requires PHP, MySQL and a web server. Check out our demo and hosting services.

EditPlus Chinese cracked version

Small size, syntax highlighting, does not support code prompt function

SublimeText3 English version

Recommended: Win version, supports code prompts!

SublimeText3 Linux new version

SublimeText3 Linux latest version

Notepad++7.3.1

Easy-to-use and free code editor