Der Markt setzt auf „Trump Trade'. Wie wird sich die US-Wahl auf die Vermögenspreise auswirken?

- 王林Original

- 2024-07-19 14:22:24521Durchsuche

1. Überblick über die Parlamentswahlen

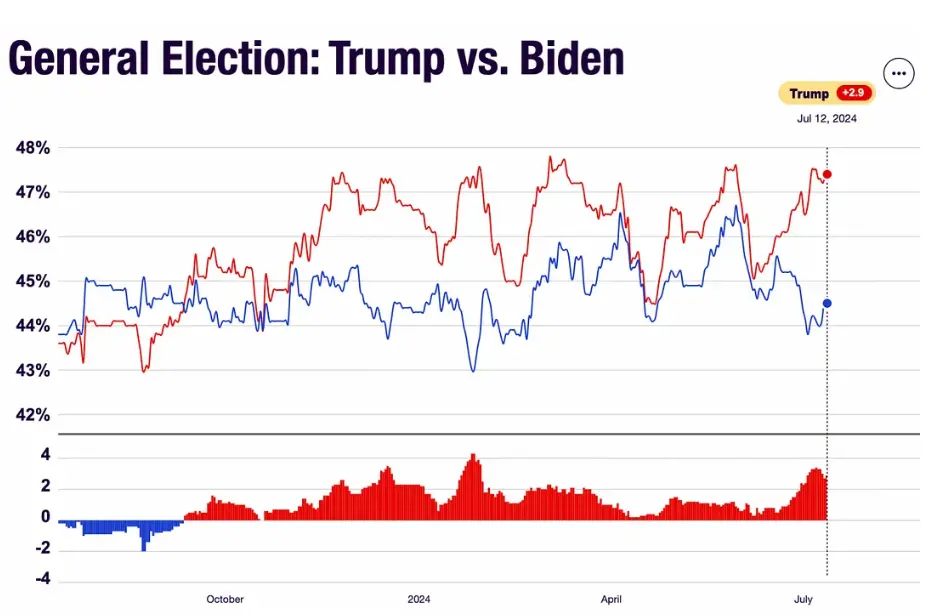

Am 28. Juni, Pekinger Zeit, führten Biden und Trump die erste Debatte über die Wahl 2024, während Bidens schlechte Leistung die mentale Einstellung der Öffentlichkeit zu seinem fortgeschrittenen Alter weckte Die Sorge, ob der Staat dieser Aufgabe gewachsen ist, ist weit verbreitet. Trumps Zustimmungswerte stiegen nach der Debatte sprunghaft an. Gleichzeitig verfügt Trump auch in den Swing States über einen überwältigenden Vorteil und führt in den sieben wichtigsten Swing States (North Carolina, Arizona, Georgia, Nevada, Wisconsin, Michigan und Pennsylvania).

There are three more critical points in the future election:

1) Two parties across the country Congresses: The Republican National Convention on July 15-18, 2024, and the Democratic National Convention on August 19-22, 2024, will select the party's presidential and vice presidential candidates respectively.

2) Second round of candidate debate: September 10, 2024.

3) Presidential election day: November 5, 2024.

2. Main Policy Differences

Trump and Biden have relatively consistent views on infrastructure, trade, diplomacy, expanding investment spending and encouraging the reshoring of manufacturing. However, they have relatively different policies on finance and taxation, immigration and new energy industries. big.

1)Finance and Taxation

Trump advocates continuing to reduce the corporate income tax from 21% to 15%, and does not advocate directly increasing fiscal expenditure; while Biden’s “Balancing Act” advocates Increase tax rates on corporations and the wealthy class, raising the corporate tax rate to 28% while continuing to forgive student loans. During the last administration cycle, Trump’s tax cuts boosted U.S. stock profits and facilitated the repatriation of overseas capital. The tax cuts proposed in this round of elections are weaker than those in the past (the last round of tax reform adjusted the tax rate from 35% to 21%). The boosting effect is also relatively weaker than in the past. CICC estimates that the net profit growth rate of the S&P 500 Index in 2025 can increase by 3.4ppt to 17% from the market consensus expectation of 13.7%.

2)Immigration

Illegal immigration in the United States has increased significantly since Biden was sworn in in 2021. Compared with Biden's moderate immigration policy, Trump advocates continuing to tighten immigration policies, but relatively relaxing the requirements for "high-level" talents. Tightening immigration policy may weaken the momentum of U.S. economic growth and push wage growth to accelerate again.

3)Industrial Policy

The two have big differences in energy and other fields. Trump advocates returning to traditional energy, accelerating the issuance of oil and natural gas exploration licenses, and increasing the development of traditional fossil energy to ensure the United States’ cost leadership in energy and electricity. At the same time, green subsidies for new energy vehicles and batteries may be canceled; Biden It advocates continuing to promote the development of clean energy.

4)Trade Policy

Both Biden and Trump are pursuing high tariff policies, which may push up the cost of imported raw materials and commodity prices in the United States, thereby creating resistance to the downward trend of CPI. The two are more radical than Trump’s policies. Biden announced in May that he would impose additional tariffs on Chinese imported goods. Biden's additional tariffs only cover US$18 billion in goods, and some of the additional tariffs will not be implemented until 2026. Trump stated that he would impose a 10% base tariff on goods entering the United States, while imposing additional tariffs of 60% or higher on China, and would also impose "specific taxes" on certain regions or industries.

You can find that Trump has significantly more green arrows in the picture above. His tariff policies, domestic tax cuts and immigration policies are not conducive to the fall of inflation.

3. General characteristics of asset prices in election years

First of all, from a full-year perspective, the overall market performance and the change in the federal funds rate during the election are not significantly different from those in other years.

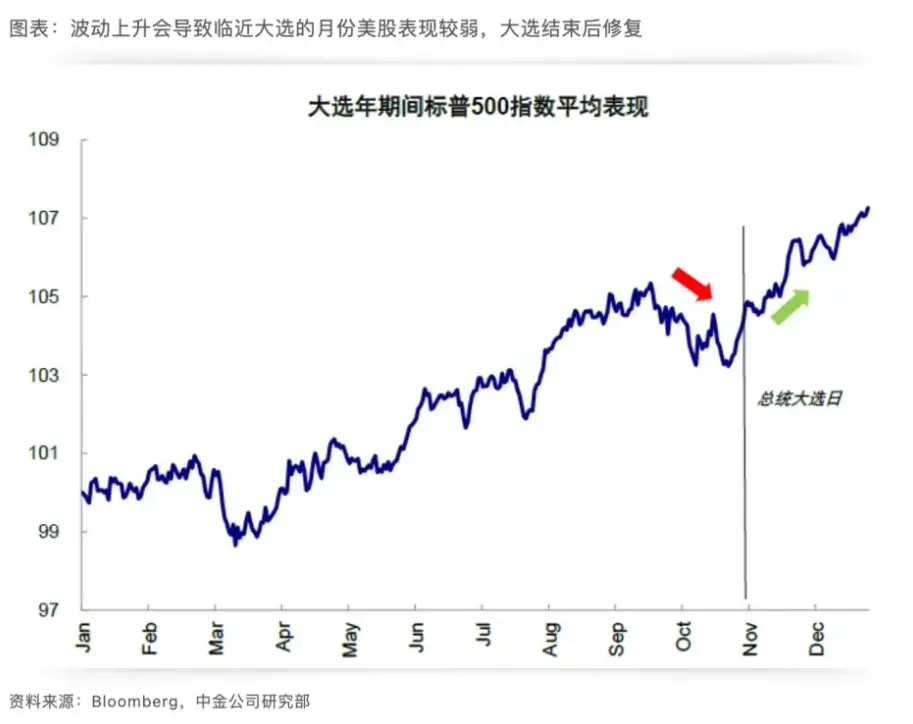

Looking at quarters and months, in the pre-election period (mainly referring to the third quarter of the election year), the change in the federal funds rate is significantly smaller than in other quarters, while asset prices show higher volatility during this period. The reason behind this may be that monetary policy tends to remain on hold as the election approaches to avoid suspicion, while asset prices fluctuate due to the uncertainty of the election results. Contrary to the seasonal pattern that is often stronger from October to December in non-election years, the stock price performance in October before the election is significantly weaker than in non-election years.

4. Review of the market situation after Trump was elected in the last round

On November 9, 2016, the preliminary results of the US presidential election were announced. Republican presidential candidate Donald Trump won the presidential election. Became the 45th President of the United States. At that time, Trump's victory exceeded market expectations and triggered asset price fluctuations. The market bet on the "Trump Trade". From November to December 2016, there were high U.S. bond interest rates, a strong U.S. dollar, and strong U.S. stocks. After the expected digestion, trading declined. Below are the price changes of various assets at that time (all on weekly charts).

U.S. bond yields rose and then fell back

Corresponding to the fluctuations in U.S. bond yields, gold first fell and then rose

The S&P rises

The Nasdaq rises

BTC rises

This round of "Trump Trade" starts much earlier, and the market is optimistic after the first candidate debate The expectation of Trump winning the election has increased significantly, and the market has begun to arrange "Trump Trade" in advance. The 10-year U.S. Treasury yield rose as high as around 4.5% on the second day of the debate.

Superimposed on the extra votes that Trump was shot on July 14th, the most likely result is that Trump is elected president and the Republican Party controls the House and Senate. We can foresee the weekend special events. Trump's shooting incident will bring a rise to U.S. stocks on Monday.

5. Summary

The impact of the US election on the market:

1) The election itself cannot be used as a reason for bullish trading. The simple logic that the Democratic Party needs US stocks to keep rising in order to win the election does not hold;

2) Regular election year 10 There is a downside risk in the market due to increased volatility around January;

3) The main direction of trading the election results (Trump Trade) is long CPI and long U.S. bond interest rates ("long" here is relative to the market's downward expectations, Its meaning is to create resistance to the decline of CPI and U.S. bond interest rates rather than an absolute rise), short gold, long U.S. stocks, but not as strong as when Trump was elected last time; long BTC (it is believed that BTC follows U.S. stocks more and is in line with U.S. stocks) Divergence not sustainable in the long term & Trump crypto-friendly).

Das obige ist der detaillierte Inhalt vonDer Markt setzt auf „Trump Trade'. Wie wird sich die US-Wahl auf die Vermögenspreise auswirken?. Für weitere Informationen folgen Sie bitte anderen verwandten Artikeln auf der PHP chinesischen Website!

In Verbindung stehende Artikel

Mehr sehen- Was ist web3? Umgangssprachliche Analyse von Web3-Formularen

- Fassen Sie Open-Source-Tools und Frameworks für die Metaverse-Entwicklung zusammen und organisieren Sie sie

- 4 mögliche Bedrohungen für Bitcoin

- DeFi-Marktaussichten im Jahr 2024: ein wichtiger Moment für technologische Innovation

- Die SEC wird nächste Woche über den Bitcoin-Spot-ETF abstimmen